5-Steps to Streamline Your Retirement Planning

(READ TIME: ~7 MN)

TAKEAWAYS:

- Without a thoughtful process, planning for your retirement can quickly become anxiety-provoking.

- Not all decisions matter, but some are crucial. A repeatable process can help you find the signal in the noise to make consistently high-quality decisions as you plan for retirement.

- By following five easy steps to focus on the right things in the right order, you can better evaluate your choices and design a retirement plan that instills confidence instead of doubt.

You do not rise to the level of your goals. You fall to the level of your systems.” – Author, James Clear (Atomic Habits)

Let’s face it: retirement planning can get overwhelming – fast. You are presented with a litany of choices, each with its unique set of tradeoffs. Luckily, you can look to others who have navigated this life transition for insight on what to focus on and when. In doing so, you can improve your decision-making while avoiding common pitfalls like focusing on the wrong things or, even worse, getting discouraged and procrastinating until a decision is forced on you.

We have had the privilege of guiding many retirees through their retirement milestones, refining our process along the way. While there is no right or wrong approach, we have found the following five steps to be highly effective in helping our clients make consistent, high-quality decisions they feel good about.

Step 1: Get Organized

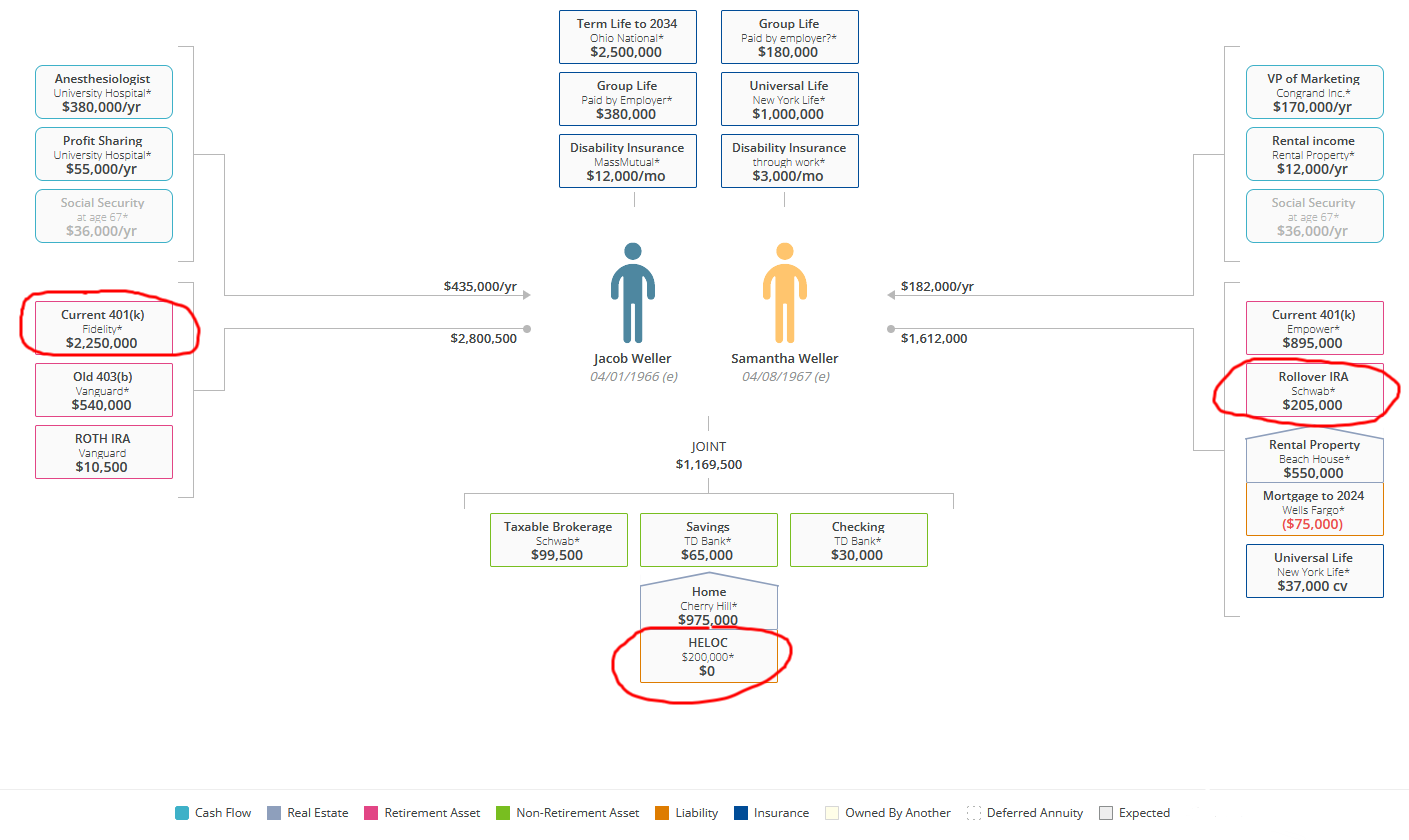

Garbage in, garbage out, as the saying goes. While “getting organized” isn’t an exciting proposition (unless you are Marie Kondo), it is vital to begin your retirement planning by clearly organizing your household’s finances. This provides many benefits, like ensuring you’re not overlooking any of your retirement resources and quickly surfacing any gaps that need addressing. Plus, it just feels good to have your arms wrapped around everything.

While spreadsheets are fine, we prefer visually organizing our clients' finances. Once your information is organized, it becomes easy to identify quick wins to help you make immediate progress.

Here are our observations for Samantha and Jacob:

- Samantha forgot to invest the $205,000 cash she rolled over from an old 401(k) into her Rollover IRA over a year ago. This needs to be addressed ASAP.

- Jacob hasn’t been maxing out his 401(k) contributions ($76,500 in 2024), but he thought he was.

- We recommended obtaining a home equity line of credit as an extra source of liquidity for emergencies and managing the sequence of returns risk.

Step 2: Create Your Retirement Vision and Spending Plan

The late Charlie Munger (Warren Buffet’s long-time business partner) was a proponent of living life backward. His life advice: write your obituary the way you want it written and then live life accordingly. It is a highly effective exercise to identify what matters most to you, to say the least.

While we’re not saying you need to write your obituary (but it might help), creating your retirement vision is necessary. Your vision is a written statement that clarifies what matters most to you by identifying your values and priorities. Without it, making high-quality decisions becomes nearly impossible because you have nothing to anchor to.

Here are some prompts to help you get started:

- What are your values?

- How do you want to spend your time in retirement?

- How do you see your lifestyle changing over time?

- How do you want your obituary to be written?

Your retirement spending plan bridges the gap between your vision and reality. Samantha envisions a retirement filled with adventure and wants to be remembered as a loving, generous mother and grandmother. After getting clear on what’s most important to her, she and Jacob add a $15,000 expense to their retirement spending plan to pay for an annual vacation with their kids and grandkids, which brings her vision to life.

Whether they have the resources to fund the family trip is a different story, which will be addressed in step 3.

Step 3: Test Your Retirement Plan for Viability

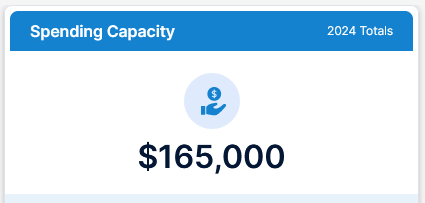

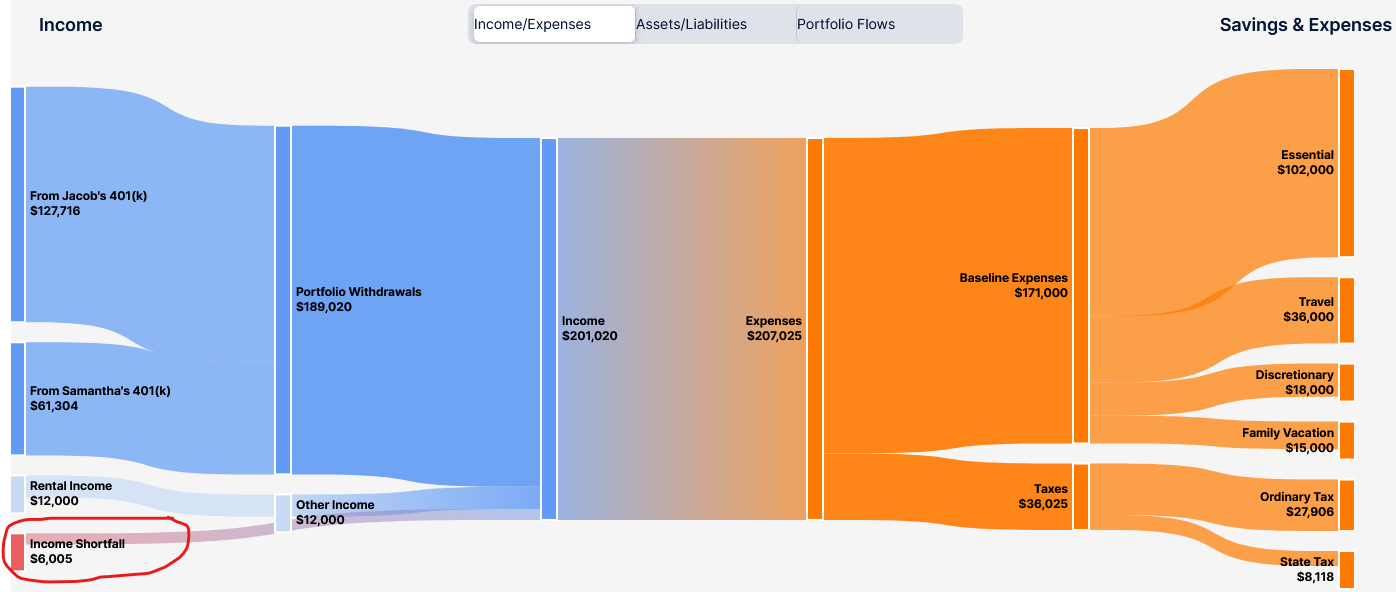

By creating your retirement vision and a spending plan that brings it to life, you have the ingredients to test your retirement plan for weaknesses. Commonly used by financial advisors, Monte Carlo analysis should be used to test the viability of your retirement plan against a wide range of investment performance. When we test Jacob and Samantha’s plan, their income (i.e., rental income and Social Security) and retirement savings (i.e., 401(k)s, IRAs, etc.) generate an annual spending capacity of $165,000 after tax.

Knowing your spending capacity is vital because it can be mapped to your retirement spending plan to determine if you are spending too much or too little, a big concern for many retirees. When we look at Samantha and Jacob’s cash flow, we can see that they have a $6,000 income shortfall, which means they must evaluate tradeoffs to make their retirement plan viable.

Based on our experience collaborating with clients, these tradeoffs tend to be relatively minor. In this case, Samantha and Jacob have $36,000 in travel expenses in addition to their family vacation expense. Trimming their travel expenses by $6,000 in exchange for the family vacation was a no-brainer.

At this point, you have a viable baseline retirement plan you can use to test other scenarios. Are you thinking of moving or buying a second home? Compare that scenario to your baseline plan to see how your spending capacity changes and make tradeoffs if necessary.

Make It Resilient

Viability isn’t enough. You need a plan that can handle life’s curve balls. Here are additional ways we test our clients' retirement plans.

Liquidity

Do you have enough non-investment portfolio income, cash, and stable investments to fund your essential spending needs after you no longer receive a paycheck? Relying solely on your investments gives you greater exposure to a sequence of returns risk, which we want to avoid. We like “laddering” stable investments, like treasuries and CDs, to fund near-term spending needs (occurring within about three years) for our clients. Laddering twelve months of essential spending needs is a good starting point, but it comes down to your unique circumstances.

Long-Term Care

According to Genworth's cost of care survey, the national median cost for a private nursing home room is about $118,000 per year! How would this cost affect your retirement income plan if you or your spouse (or both) needed long-term care? Better test it!

Early Death

If you or your spouse died prematurely, how much of your planned retirement income would be available to the surviving spouse? We often see an inadequate “survivor income ratio” when one spouse receives a large pension (without a 100% survivor option) or when a couple is more than five years away from retirement and doesn’t have enough life insurance.

Step 4: Go From Good to Great by Optimizing

The things you read about in the financial media (we’re looking at you, Forbes, and CNBC) often fall into the optimization category, so it’s unsurprising if your instinct is to skip the first three steps and start here. Roth conversions, tax-loss harvesting, social security claiming strategies, and distribution planning (to name a few) are ways to optimize a viable and resilient retirement plan. Hence, we save them for step 4.

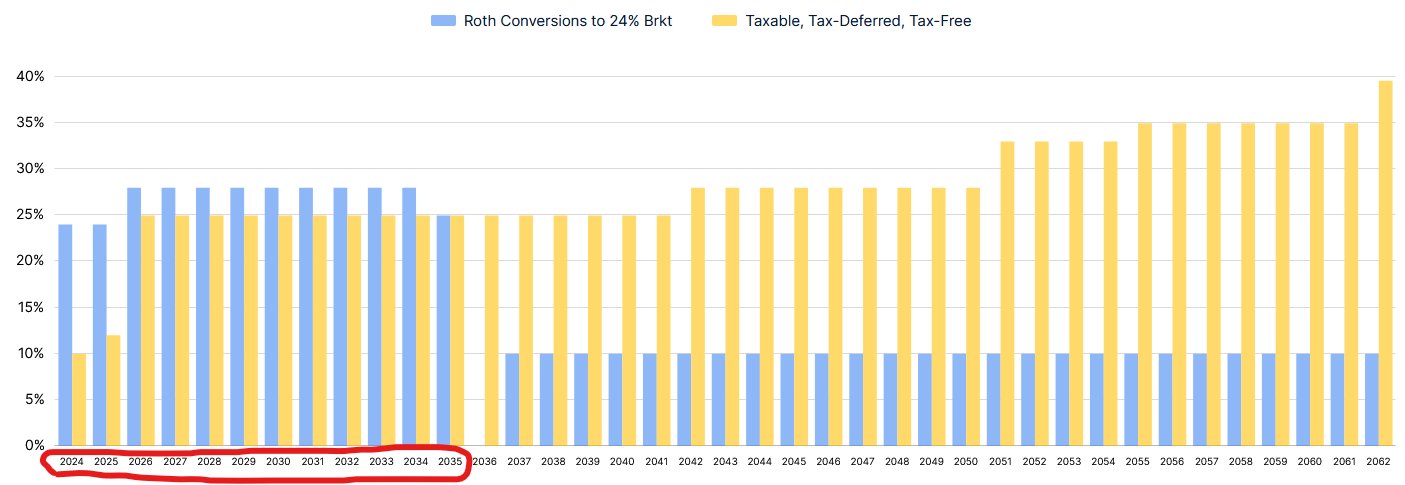

Of these topics, Roth conversions are arguably what we get asked about the most. The benefits of this strategy depend on your unique circumstances, so you will need to run your analysis to determine whether they’re right for you. But to give you an idea of how we approach this topic with clients, let’s look at how we would evaluate the merits of Roth conversions for Samantha and Jacob.

Upon reviewing their assets, their poor “tax allocation” immediately jumps out at you -- 97% of their assets are in pre-tax accounts (401(k)s and traditional IRAs)! While nothing is inherently wrong about this, it represents a (growing) tax obligation to Uncle Sam that is compounded if their tax rates rise in the future, which is a reasonable assumption.

When we create a tax projection, we see that their tax rates will rise if they take no action and follow the conventional “taxable, tax-deferred, tax-free” distribution strategy (yellow bars). However, suppose they were to take advantage of their low tax rates early in retirement by systematically converting their pre-tax accounts to Roth IRAs to “fill up” the 24% tax bracket (28% starting in 2026) over the next ten years (red circle). In that case, they dramatically change the trajectory of their tax brackets (blue bars).

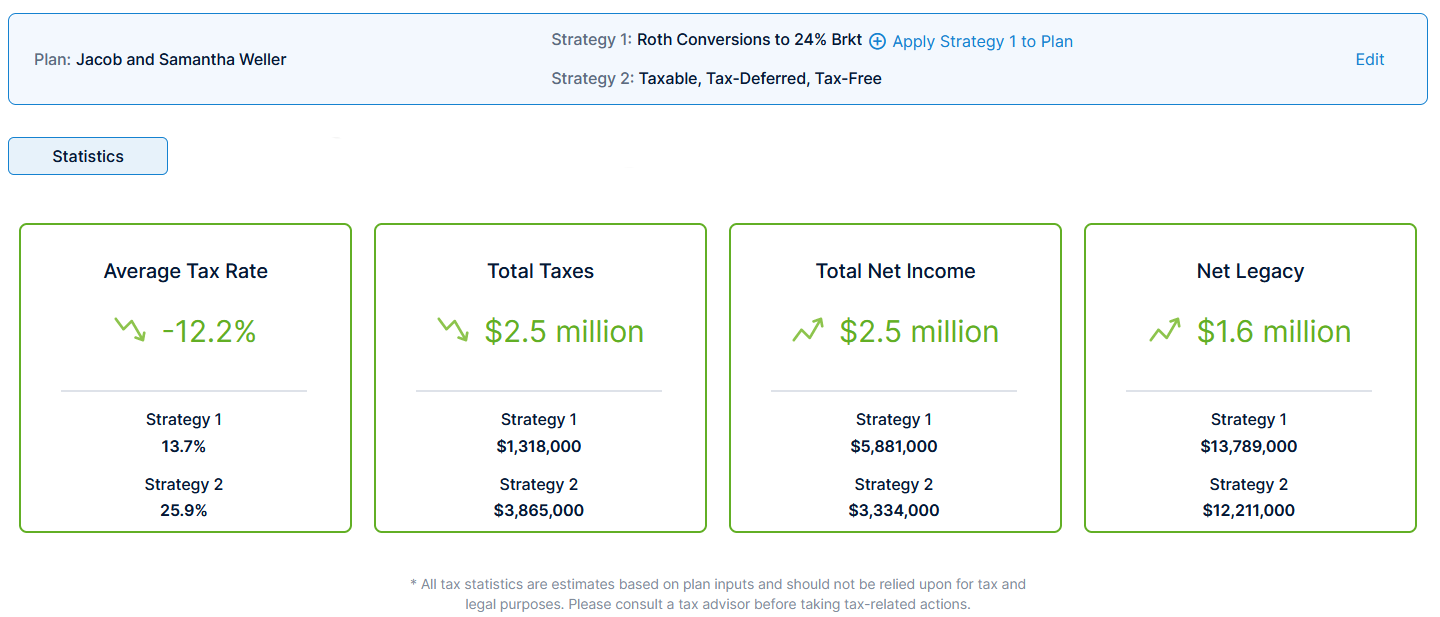

We get some eye-popping stats when we crunch the numbers. Roth conversions can potentially slash their lifetime tax bill by 65% ($2.5M) and increase their retirement income by 75% ($2.5M)! Needless to say, Roth conversions offer an excellent opportunity for Samantha and Jacob's retirement plan to go from good to great.

Step 5: Adapt With Your Retirement GPS

You have created a resilient and optimized retirement plan that helps you live your retirement vision, but you're not off the hook! Things change, so your plan must adapt to the ebbs and flows of life.

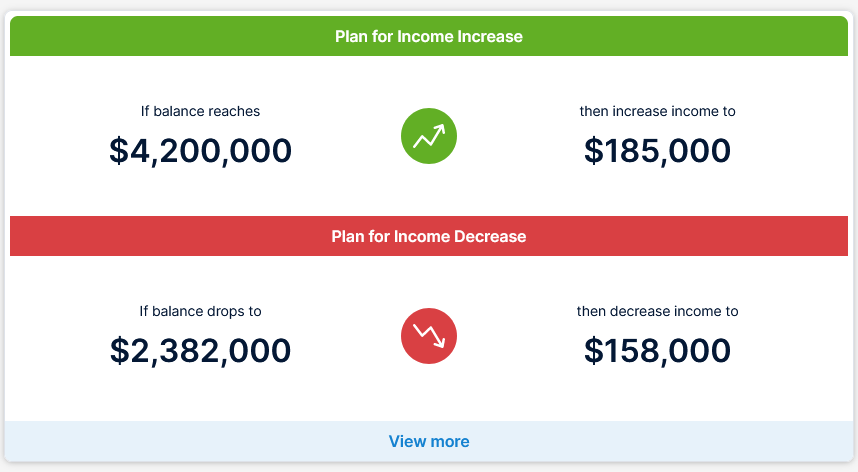

Let's look at Samantha and Jacob’s financial dashboard. We can see the “income guardrails” we would use to keep their retirement plan on track by calling for income increases or decreases based on the value of their investment portfolio. For example, if their portfolio balance grew to $4.2M (from ~$4M today), they could increase their annual spending by $20,000 to $185,000 after tax (more travel!). It is like Google Maps, taking in real-time information and recommending the best routes to your destination.

Even if you don’t have access to an income guardrails tool like ours, you can proactively create a plan to trim spending during bad times and increase spending during good times to strike a balance between living your best life today without sacrificing tomorrow.

An Evergreen Framework

These five steps provide a valuable framework for evaluating the numerous choices that you have in retirement. It’s evergreen and allows you to cycle back through the steps to keep your plan current as your life changes. If you would like guidance creating a retirement plan that streamlines good decision-making and instills confidence, we are here to help. You can click here to schedule an informal, introductory Zoom call to get started.