Avoid This Common Charitable Giving Mistake to Max Your Tax Savings (and Impact)

(READ TIME: ~6 MIN)

TAKEAWAYS:

- Many people unknowingly miss out on a big benefit of charitable giving – tax savings – by not having a giving strategy.

- Developing a multi-year giving strategy using a donor-advised fund can unlock sizeable tax savings and help boost impact.

- For people ages 70.5+, Qualified Charitable Distributions (QCDs) offer even greater tax savings.

Individuals account for the majority of U.S. charitable giving. This isn’t surprising given the many benefits of charity, like improving society, bettering our health, expressing our values, and, of course, tax savings. Although financial benefit isn’t the primary motivator behind giving, developing a multi-year giving strategy can maximize the win-win scenario by boosting not only your tax savings but also your impact. But despite the tremendous benefits of having a strategy, many people approach their giving on a year-to-year basis, often resulting in no tax benefit at all (much to their surprise)!

Tax Law and The Need for Strategic Giving

The ability to receive a tax deduction for charitable gifts has become much more challenging due to the 2017 Tax Cuts and Jobs Act, which nearly doubled the standard deduction for taxpayers. In fact, approximately 90% of taxpayers now take the standard deduction (versus ~70% before the TCJA)! This matters because charitable gifts are an itemized deduction, meaning your gift and other itemized deductions (like mortgage interest) must be greater than your standard deduction to receive tax savings.

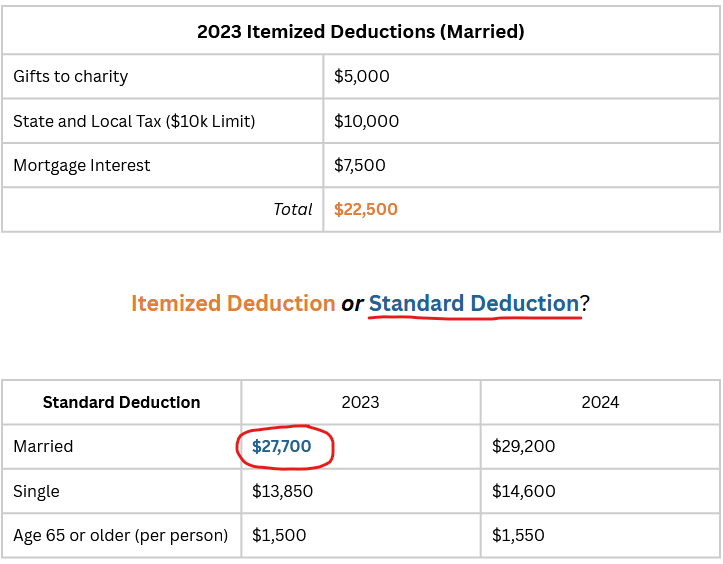

Here’s an example of something we see all too often. In this case, a married couple gives $5,000 to charity in 2023. However, as you see, they don’t receive a tax benefit from their gift because their itemized deductions are less than their standard deduction ($27,700 for a couple under age 65).

“Batch” Your Gifts with a Donor-Advised Fund

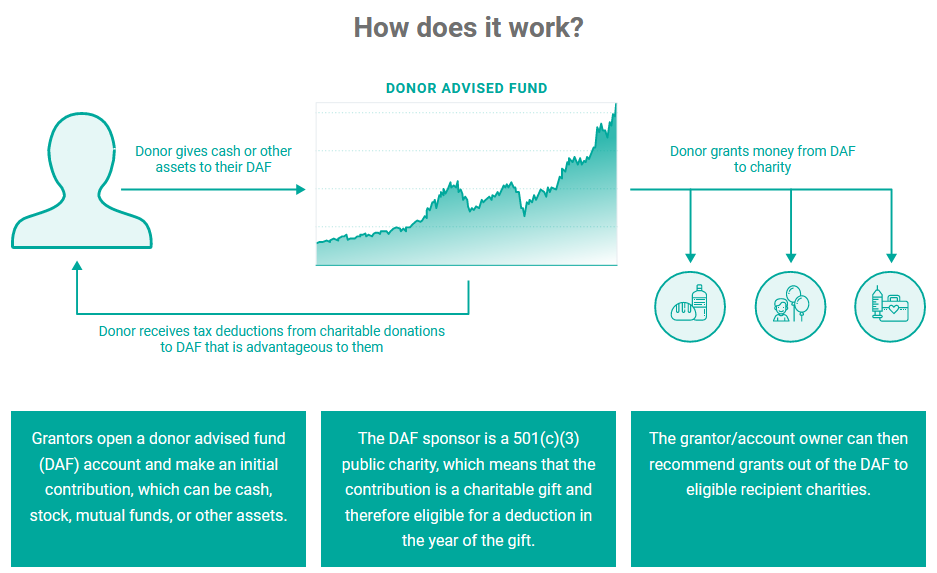

Just like how 401(k)’s are tax-advantaged accounts for retirement, donor-advised funds are tax-advantaged accounts for charity. And, when used smartly by “batching” multiple years of gifts into one year, they allow you to maximize your tax savings.

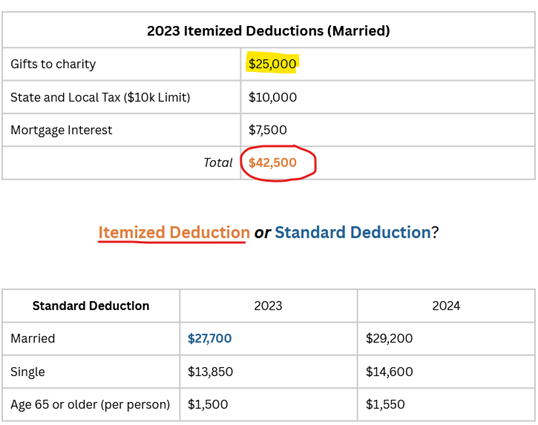

Let’s assume that our married couple decides to batch five years of their gifts into one year by making a $25,000 contribution (5 x $5,000 annual gift) to a donor-advised fund in 2023. By employing this giving strategy, they can report the full $25,000 gift on their 2023 tax return, allowing them to take advantage of itemizing their deductions. This reduces their income by $14,800 more than if they settled for the standard deduction ($42,500-27,700 = $14,800)!

For the 2024 tax year, they would switch back to taking the standard deduction until they are ready to “batch” additional contributions to their donor-advised fund. Lather, rinse, repeat.

We recognize that (most) people don’t want to give multiple years of gifts to charities all at once, and with a donor-advised fund, you don’t have to. Although our hypothetical couple contributed five years of gifts to their donor-advised fund in 2023, they have the option to give the entire $25,000 to charities immediately (in 2023) or spread the gifts across five years (or whatever gifting schedule they want). Remember that a donor-advised fund is a tax-advantaged account, and, like a 401(k), you can invest your contributions to grow the account balance (tax-free) and make disbursements when you choose. When considering investment growth, our couple’s $25,000 contribution can potentially fund more giving over five years than they had planned. This can help them make an even greater impact or reduce the dollar amount necessary for their initial contribution.

Boost Your Tax Benefit

Contributions to donor-advised funds can be either cash or assets. We can’t emphasize this enough because contributing assets – specifically appreciated assets, like stock – are much more advantageous than cash. This is due to two reasons: (1) you receive a tax deduction based on the market value of the stock at the time of the contribution to your DAF, and (2) you get rid of the future capital gains tax obligation that’s embedded in the stock’s value.

In the example above, Apple stock bought ten years ago for $5,000 is contributed to a donor-advised fund. The Donor reports the stock's current market value ($55,000!) as a charitable gift (an itemized deduction) on their 2023 tax return. If they’re in the 24% federal tax bracket, this represents a $13,200 tax savings (even bigger if we factored in state taxes)! If that isn’t compelling enough, they also eliminate the $9,400 future tax liability that would have been triggered when they sold the Apple stock (15% long-term capital gains rate + 3.8% net investment income tax).

Don’t Forget Qualified Charitable Distributions (QCDs)

If you’re age 70.5 or older and have an IRA, a potentially more powerful giving option is available. Qualified Charitable Distributions (QCDs) are gifts made directly from IRAs to qualified charities. You don’t need to itemize deductions to receive a tax benefit from a QCD (unlike DAF contributions), and because they are an “above-the-line deduction,” you receive the full deduction for your charitable gift (up to the $100,000 annual limit), which isn’t always the case for itemized charitable deductions. And while we are big fans of donating appreciated assets, QCDs go towards satisfying required minimum distributions and offset income taxed at higher tax rates (ordinary income from IRAs) versus preferential long-term capital gains rates. This means that, depending on your situation, QCDs may be more advantageous.

The takeaway is that a meaningful tax savings opportunity exists in taking a strategic approach to charitable giving. Many rules add constraints to using donor-advised funds and qualified charitable distributions, so your giving strategy must be tailored to your unique circumstances and preferences.

If you need help developing a giving strategy to maximize your tax savings and impact, we are here to help. You can click here to schedule an informal, introductory Zoom call to get started.