Developing a Retirement Income Strategy to Minimize Lifetime Taxes

For most financial advisors, retirement planning begins and ends with a “determination” of how much one can sustainably spend from their investment portfolio given a certain probability of success based on Monte Carlo Analysis. This kind of retirement planning is far too basic and limited. There is SO much more to proper retirement planning. For beginners, spending sustainability should be tested by Historical Simulation Analysis in addition to Monte Carlo Analysis because both approaches have their pros and cons. Further, most financial advisors lack the understanding of and ability to model the application of dynamic withdrawal rules. The application of dynamic withdrawal rules is, in most cases, the single most powerful tool we have in our tool chest (see our Insight entitled "Quantifying the Value of Dynamic Withdrawal Rules" for more). Nevertheless, the end goal of spending sustainability analysis is to determine how much someone can withdraw from their portfolio without taking on too much risk or running out of money.

Where most financial advisors (and consequently clients) miss the boat is that once this spending (or withdrawal) number has been determined, they fail to realize the enormous value potential of determining an optimal retirement income strategy.

What is a Retirement Income Strategy?

A retirement income strategy is about developing a withdrawal order sequencing strategy that can minimize the amount of taxes you pay over your remaining lifetime. Of all the strategies that fall under the category of tax management (see our Insight entitled "Strategies to Manage Taxes in Retirement" for more), the development of an optimized retirement income strategy has the potential to yield the most significant benefit. In fact, the development of an optimal retirement income strategy lies just under the application of dynamic withdrawal rules in terms of the magnitude of potential value creation.

When and which type of account (i.e., taxable, tax-deferred, or Roth) you take money from to fund your retirement expenses can matter significantly because of the different tax rules that apply to each account type. There is a retirement income strategy rule of thumb known as Conventional Wisdom. Conventional Wisdom states you should fund retirement expenses from taxable accounts first, then pre-tax retirement accounts, and then Roth accounts. The logic is that money from a taxable account is the best place to start because only the gain on the proceeds gets taxed at a lower capital gains rate (15% or 20%). Plus, this allows greater time for pre-tax retirement accounts to grow pre-tax. After the taxable account is depleted, Conventional Wisdom states that your pre-tax retirement account is the next best, so you can allow your Roth account the longest time possible to grow tax-free.

Like most rules of thumb, Conventional Wisdom, while easy to understand and follow, is entirely overly simplified. In reality, the best retirement income strategy is the one that puts you in a position with the optimal mix of money in the various account types so that you can take a portion from each to stay under your highest marginal tax rate each year in retirement. Clearly, this involves a lot of inputs and math to determine.

Determining a Retirement Income Strategy

A retirement income strategy takes into consideration the following factors:

- your amount of annual spending (or withdrawal)

- your current and future potential mix of investment accounts (i.e., taxable, tax-deferred, and Roth)

- your current and future potential marginal tax rates

- your goals

- your asset allocation

- your potential Roth conversion strategies (to change your mix of investment accounts)

Given your inputs and assumptions, possible scenarios should be modeled to determine which retirement income strategy requires the lowest amount of remaining lifetime taxes. As you can imagine, there are thousands of different possible scenarios. This again is where working with a retirement specialist can have its benefits (see our Insight entitled "Retirement Specialist or Financial Advisor" for more). Through a system dedicated solely to this analysis, we can run nearly 3,000 possible scenarios and stack rank the top 100. Just because a strategy ranks as best mathematically does not always mean it’s a good fit for the client, but it’s a great place to start the conversation.

An Example

Working with many physicians and other high-net-worth individuals, we encounter a very common scenario where a couple has most of their money in taxable (i.e., after-tax brokerage savings) and pre-tax retirement accounts. Very little tends to be in Roth treated accounts because high-income earners are quickly phased out of being able to contribute, and Roth conversions can be less beneficial during peak earnings years. The following example is based on this type of couple with an after-tax spending goal of $220,000 per year and $3,700,000 in investment assets.

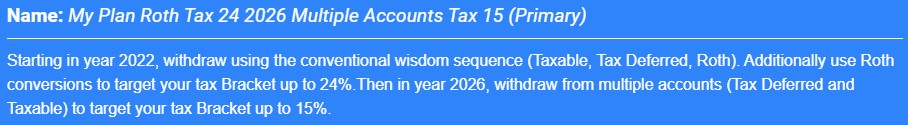

After entering all the required data, the following retirement income strategy is recommended as best, and it happens to fit well for this hypothetical couple:

In English, this income strategy suggests the couple begin funding their retirement from taxable brokerage savings for the first four years while also completing Roth IRA conversions up to their 24% marginal tax bracket. Then starting in 2026, this couple should have a mix of investment accounts that will allow them to take a portion from all sources of savings such that they stay under the 15% marginal tax bracket for the remainder of their retirement.

Drivers of Value

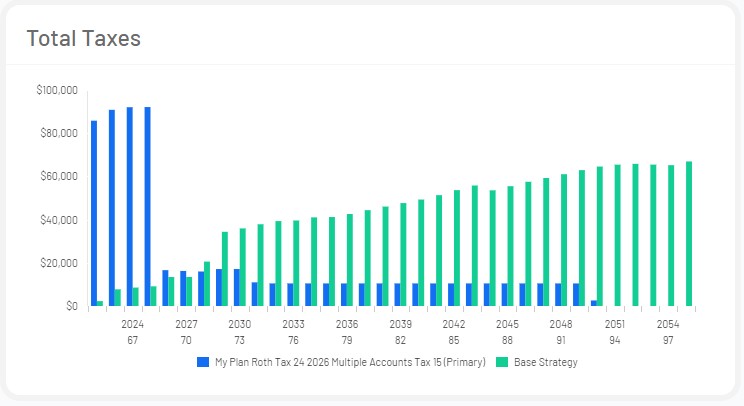

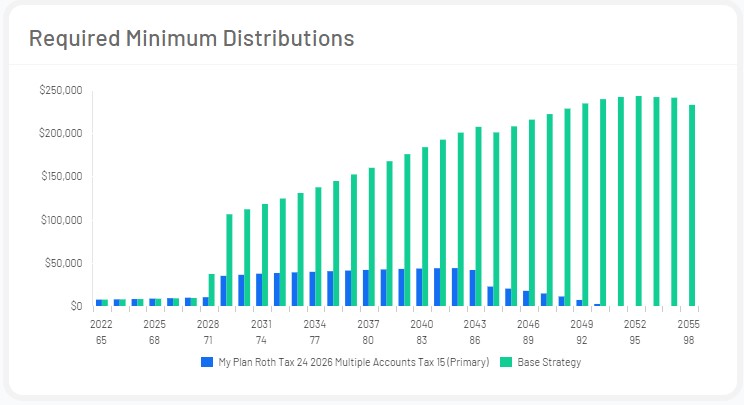

A couple of different factors are driving the value of this strategy. First, the suggested Roth IRA conversions are being done while under today’s far more generous Tax Cuts and Jobs Act tax rates set to expire after 2025. The income recognized by the Roth IRA conversions is being taxed at today’s lower rates (see our Insight entitled "What Drives Value in a Roth IRA Conversion Strategy" for more). Roth IRA conversions will substantially increase taxes over the next four years but will result in much lower tax bills beyond. This is because pre-tax retirement money (and the subsequent growth on that money) is moved into the Roth IRA, which greatly reduces the pre-tax account and the amount of future required minimum distributions (RMDs) that would eventually be taxed at even higher rates. You can see this in the illustrations below:

Quantification of Value

This retirement income strategy results in a total estimated remaining lifetime tax bill of $850,860 versus the “Base Strategy” (i.e., Conventional Wisdom) scenario’s total of $1,846,015 as can be seen in the schedule below (sorry it is so small):

This represents a very material tax savings of $995,155 over 33 years. Not bad!! Furthermore, any money left at passing will all be in a Roth IRA instead of a pre-tax IRA. This is significant as any retirement account money passed to a non-spouse beneficiary must be taken within ten years. If the money is in a Roth IRA account, the beneficiary can let it continue growing tax-free for ten years and then withdraw it all tax-free. If the money is in a pre-tax IRA, the beneficiary is in a tax trap and will likely have to take a portion each year to avoid the bulk being taxed at the highest marginal tax rates. This can be especially problematic for beneficiaries in their peak earning years. Who knows where tax rates will be then, but the highest marginal federal income tax rate will be 40% starting in 2026. Between state and federal taxes, you can easily see a scenario where up to one-half of one’s legacy could be going to the government through taxes rather than to their intended beneficiary.

If you would like help in developing your optimal retirement income strategy, we stand by ready to help. To learn more, you can schedule a friendly, informal call for a date and time that is convenient for you here at this link: https://calendly.com/thriveretire/thriveretire-call or contact us here at any time.