Secure Your Retirement Income: Lock in High Interest Rates Now

(READ TIME: ~5 MIN)

TAKEAWAYS:

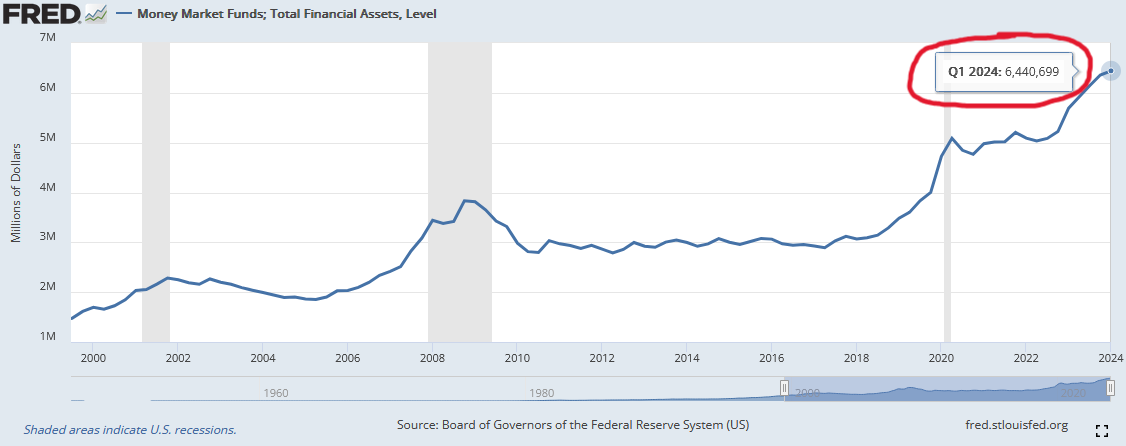

- Investors are hoarding cash, near a record high of ~$6.4 trillion in money market funds.

- Today's luring 5%+ cash yields will drop quickly if the Federal Reserve cuts interest rates.

- Now is an excellent time to "lock in" rates by shifting cash into longer-term investments, like bonds.

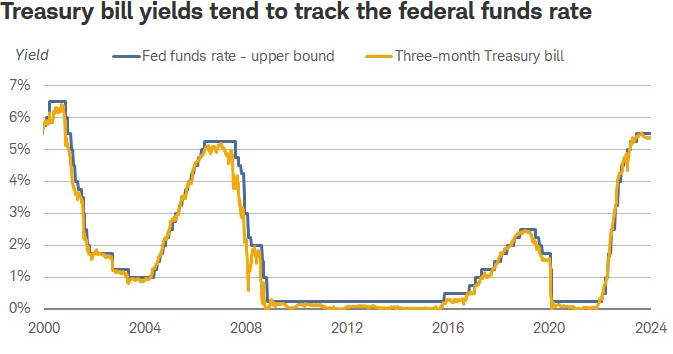

The interest rate set by the Federal Reserve (i.e., the federal funds rate) is at its highest level in over 20 years, with a current target range of 5.25% -- 5.50%. Since cash yields, like those of money market funds, CDs, and savings accounts, closely track the federal funds rate, it's no surprise that money market balances are near an all-time high of $6.4 trillion. In 2023 alone, $1.2 trillion was added to money market funds (a 22% annual increase) – the largest on record!

But despite today's 5%+ yields seeming like a win-win-win scenario (attractive yield, low risk, and liquid), cash is not risk-free. By holding too much cash or cash-like investments, retirees expose themselves to reinvestment risk (the inability to reinvest cash at yields like today's), which will rear its ugly head if the Federal Reserve starts cutting interest rates as expected. Reinvestment risk can lead to retirees' nest eggs not growing enough to keep up with (or beat) inflation, jeopardizing their desired retirement lifestyle. While the path of interest rates is uncertain, now is an excellent time to consider alternatives to your cash holdings, like longer-term bonds, to "lock in" rates.

Cash and Bonds Serve Different Roles

It's tempting to substitute bonds with either cash or cash-like investments, such as money market funds and CDs. For example, at the time of writing, the Schwab Value Advantage Money Fund (ticker SWVXX) is yielding 5.14%, whereas the Vanguard Total Bond Market ETF (ticker BND) is yielding 4.53%. So, the choice appears to be between an investment with a higher yield and no price volatility (money fund) and an investment with a lower yield and price volatility (bonds). But that's not the whole picture.

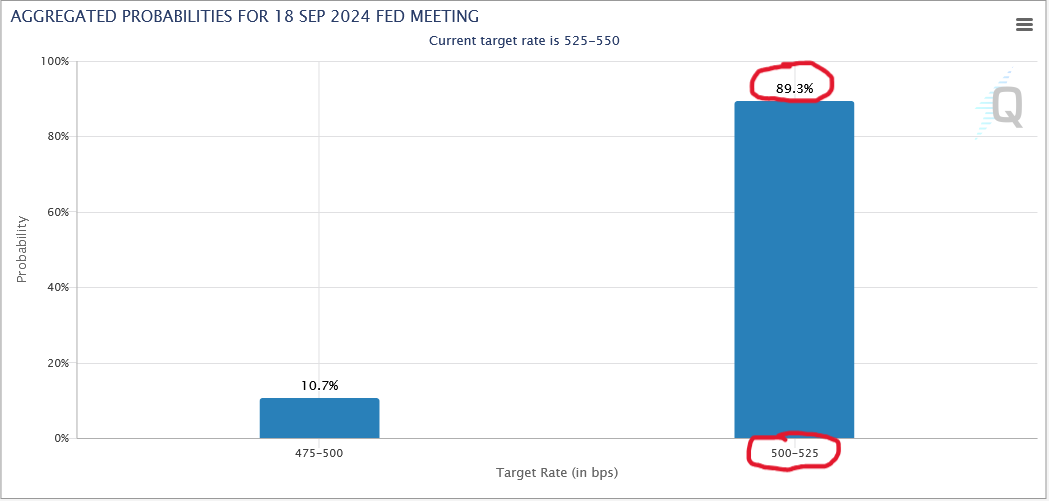

With cooling inflation, the Federal Reserve is expected to begin cutting interest rates soon. Although we don't know when they will start, financial market data suggests traders expect a 0.25% rate cut in September 2024 (to a range of 5.00% – 5.25%), with additional cuts in 2025.

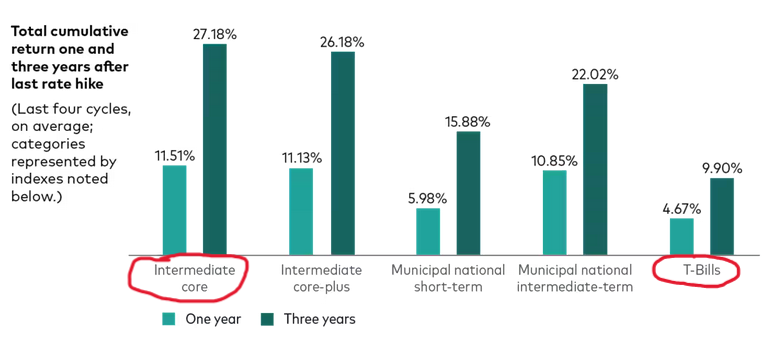

If interest rates are cut, cash yields will drop quickly, and retirees' long-term returns may suffer by not having owned more bonds instead. Case in point: Over the last four interest rate cycles, intermediate-term bonds (i.e., bonds with a 4-10 year maturity) have outperformed cash (Treasury bills as a proxy) by ~7% and ~17% one and three years, respectively, after the Fed's last interest rate increase.

Cash and bonds serve different roles. Cash is good for contingencies and near-term spending, whereas bonds, with their yield and potential for capital appreciation, can better fund spending later on in retirement.

How to Lock In Your Rates

Financial markets are forward-looking, meaning prices are based on investors' expectations. As the chance of an interest rate cut increases, longer-term bond yields decrease (more demand leads to a lower yield). Because of this relationship, it's best not to wait until the Fed cuts rates to buy bonds.

Cash Needed Within Three Years

Given their flexibility, money market funds and high-yield savings accounts are still great options for your cash reserves and any cash you anticipate needing over the next year or so. Yes, their yields will drop if interest rates are cut, but these dollars are required for contingencies and near-term spending, not long-term growth. For any cash you anticipate needing in about two to three years, consider buying CDs or individual treasuries as a way to benefit from today's rates for a bit longer than money market funds. Yields on these investments have already started to drop in anticipation of rate cuts (remember, markets are forward-looking). However, there is still a benefit to locking in rates and removing uncertainty about funding near-term spending.

Using this approach, we build fixed-income "ladders" to create a stable source of near-term income for our clients. This provides them with the confidence to spend during market turmoil by protecting against sequence of returns risk.

Beyond Three Years

Consider buying longer-maturity bonds for cash you don't anticipate needing to tap into for at least three years. A low-cost, intermediate-term bond ETF can be the workhorse for most retirement portfolios, but the suitable investment depends on your preference and unique circumstances. Of course, this assumes that your cash (and cash-like investments) were bought to substitute bonds. If you simply have a cash surplus, shifting cash into a mix of bonds and stocks may be best, but that's beyond the scope of this blog post.

Inertia is a powerful force; don't let it prevent you from locking in today's interest rates. If you want help developing a strategy for your cash, we are here to help. You can click here to schedule an informal, introductory Zoom call to get started.