Shield Your Nest Egg: 3 Essential Fraud Prevention Tips Every Retiree Needs to Know

Takeaways:

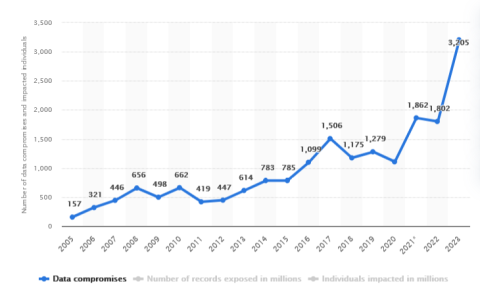

- The number of data compromises affecting organizations has skyrocketed, from 614 cases in 2013 to 3,205 cases in 2023 – a 422% increase!

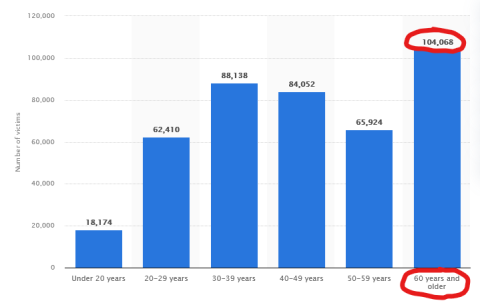

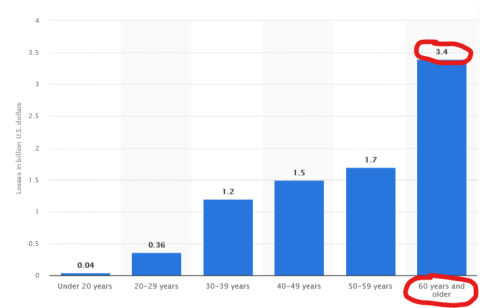

- In 2023, people aged 60 and over suffered the highest financial loss from cybercrimes compared to all other age groups.

- Retirees must protect themselves from the inevitability of their highly sensitive personal information being compromised.

Have you tried to Google yourself lately?

If so, you might be surprised with what you find. Nowadays, it's not at all uncommon for personal information like home addresses (current and past), date of birth, email addresses, cell phone numbers, and the names of relatives to be available online—a treasure trove of information for scammers wanting to harm.

So, who's making your personal information available online? Two words: data brokers.

Data brokers are businesses that aggregate people’s personal information through various sources to sell for profit. Their customers include advertisers, insurance companies, financial institutions, political consultants, etc.

The problem is that it’s likely that you aren’t aware that these companies are collecting and selling your data, nor that some are household names that are part of your daily life.

And this is a big deal, because once someone has access to your data, they may be one step closer to being able to obtain access to your assets. As retirement planning specialists looking after our clients’ best interests, we want to ensure your entire nest egg is protected, not just from market-related events, but also from threats like this that could bring both financial and mental stress.

Data Brokers (Any Look Familiar?)

While data brokers aren’t necessarily bad, they do pose a risk to everyone, especially retirees. Data compromises have exploded over the past decade, increasing 422% from 2013 to 2023, according to Statista. Often, hackers target data brokers due to the vast amount of personal information they hold, a prime example being the Equifax breach of 2017, where data for almost 150 million Americans was exposed.

The Latest Numbers When It Comes to Data Compromises

Here are some of the fascinating numbers behind data compromises as of lately.

The Annual Number of Data Compromises

By accessing an ever-growing amount of your personal information, scammers can target you with more sophisticated (i.e., believable) scams. Real-world examples include highly customized emails that appear to be from friends or colleagues containing clickable links that give hackers access to your computer and a phone call from someone claiming to be the police informing you that your granddaughter (whom they reference by name) has been arrested and needs money for bail. And as you age and experience cognitive decline, your vulnerability to these threats increases.

Number of US Cyber Crime Victims in 2023 by Age Group

Monetary Loss through Cybercrime in 2023 by Age Group (in billions)

Protecting yourself from cyber criminals requires a multipronged approach. If we’re operating under the assumption that your highly sensitive personal information, like your social security number, is already available to criminals (sadly, a safe assumption), then stemming the flow of additional personal information being released combined with measures to limit the amount of damage that can be done is crucial.

Here are three tips retirees can take to protect themselves from fraud:

1. Delete Your Personal Data from Online

The first step is to decrease the amount of information you share online. You can do this by updating the privacy settings on your web browser and the phone apps that you use.

Essentially, you will only want to share the bare minimum information necessary to use the service, which is not the default setting.

Next, Google yourself to see which websites (i.e., data brokers) list your personal information. Common websites include Whitepages, Spokeo, and BeenVerified. Once you’ve identified the websites, opt out of sharing your information with each of them to prevent your personal data from appearing in online searches. Each website will have different steps to opt-out, so we recommend using an opt-out guide, like the one provided by the online privacy company DeleteMe, to make the process as painless as possible.

2. Use A Password Manager

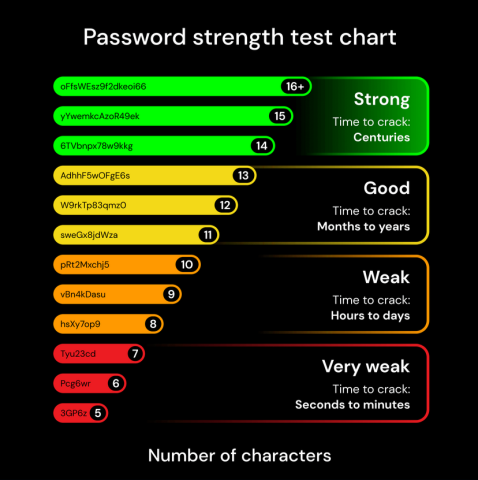

If you’re like most people, you use the same password across multiple websites. And that password is probably easy to remember (why else would you use it), meaning that it has a small number of characters and includes personal information, like your name or birth year. If that’s the case, stop making hackers' jobs so easy!

Using unique and complex passwords is critical to keeping your online accounts secure. Luckily, there are tools that can help you generate and manage these passwords so you’re not keeping them in a spreadsheet or document on your computer (another big no-no) or trying to remember them.

While we don’t recommend a specific password manager, 1Password, Bitwarden, and LastPass are widely used. As an added security layer, enable two-factor authentication or Face ID for your online accounts.

3. Freeze Your Credit

“Freezing” your credit protects you from financial fraud by preventing new lines of credit from being established under your name. Paying for a criminal’s Italian vacation on a newly opened AMEX unbeknown to you – no, thank you!

This is low-hanging fruit since credit freezes require a minimal time investment while mitigating a huge risk. You will need to place a credit freeze with each of the three main credit bureaus – Equifax, Experian, and Trans Union – either online or by phone.

But remember that you will need to “unfreeze” your credit before applying for new credit (think mortgage or an auto loan), but only with the credit bureau used by your lender. We recommend asking your lender which bureau they pull credit from ahead of time to avoid delays.

Our digital footprint expands as we spend more of our lives online. While you can’t eliminate the risk of your personal data falling into the hands of scammers, you can take steps to reduce the probability of it occurring and the amount of financial harm.

As retirement planning specialists, we spend a lot of time helping retirees navigate the big five retirement risks. And because we also care about making sure that your assets and data are protected, we consider all threats to our clients, including cyberbreach threats. If you’d like us to help you prepare a retirement plan, you can get in touch with us here.