Total Cost of Investing - The Easiest of Retirement Optimization Strategies

Optimizing Limited Retirement Resources

Given their limited resources, retirees are often searching for ways to make the most of their situation. One of the most natural places for retiree’s heads to go first is to managing taxes. Because of the progressive tax system in the United States and the system of marginal tax rates employed, there are indeed numerous strategies to successfully manage one’s taxable income. Managing taxable income is about strategically realizing (or not realizing) categories of incomes in an attempt to optimize one’s situation in any given year. This is usually done through employing a combination of strategies such as Roth conversions, coordinating account distributions, tax-loss harvesting, tax-gain harvesting, asset selection, and asset location, to name a few. Managing taxable income can be complicated stuff. It is uniquely personal, and there aren’t any hard and fast rules to follow. Strategies will vary from person to person and even year-to-year for the same person.

While complicated, managing your taxable income can for sure add material value. Two well-known industry studies have been done by Vanguard and Morningstar that attempted to quantify the strategies mentioned and others. In their Advisor’s Alpha study, Vanguard found that up to 1.10% of value can be created from an optimal withdrawal strategy, and another up to 0.75% of value can be created through the deployment of an effective asset location strategy. Morningstar’s Gamma study is much more conservative at a little over a half percent of value for both, though many practitioners see some fault with their level of conservatism. Regardless, I think it’s fair to say there is some real value in adopting some of these strategies, whether you do it yourself or with the help of a financial advisor able to leverage specialized modeling software.

For the most part, everyone is aware of the opportunity that tax efficiency brings in retirement. But there are three other optimization strategies that are often neglected or not even thought of at all. It is a shame, too, because these other three strategies can have an equal or even more significant impact on potential retirement outcomes as paying attention to taxes. Additionally, at least one of them is a lot less complicated to employ than managing taxes! And that one is understanding your total cost of investing.

What's Your Total Cost of Investing?

In practice, when I ask someone if they know what their total cost of investing is, I am often met with blank stares. Given the unfortunate level of opaqueness in the Wealth Management Industry, it’s not altogether surprising. For beginners, most people don’t know if their advisor works for a Registered Investment Advisors (RIA) or Broker-Dealer (BD) and which standard of care is owed to them. Further, compensation structures vary widely in amount and structure. Compensation structures can include sales commissions, percentage of assets under management (% AUM), a flat recurring fee (retainer-based), a flat non-recurring fee (fee for service-based), or hourly (hourly based). And if this were not already confusing enough, financial advisor titles aren’t standardized and do not require qualification, so anyone can call themselves anything.

I’ve actually spoken to people who thought they did not pay anything to their advisor. Imagine their surprise when I showed them that they were right in that they were not paying any ongoing management fees to the advisor, but that was only because their advisor was a broker working under a broker-dealer. They aren’t legally allowed to offer financial advice for a fee. Instead, they are legally only allowed to sell financial products for commissions. These poor people were sold A-share mutual funds at the typical front-end commission of 5.25%. One couple paid well over $60,000 of commissioned fees to their advisor and literally had no idea. To add insult to injury, I then have to share the high expense ratios that typically accompany such commissioned “investments.” This story happens all the time and always ends with the same feelings of shock and anger.

To protect yourself, you should know your total cost of investing. Understanding and then potentially lowering your total cost of investing could be one of the easiest moves you can make to optimize your situation and make more of your limited resources. It is certainly easier than managing taxes, but no less potentially impactful.

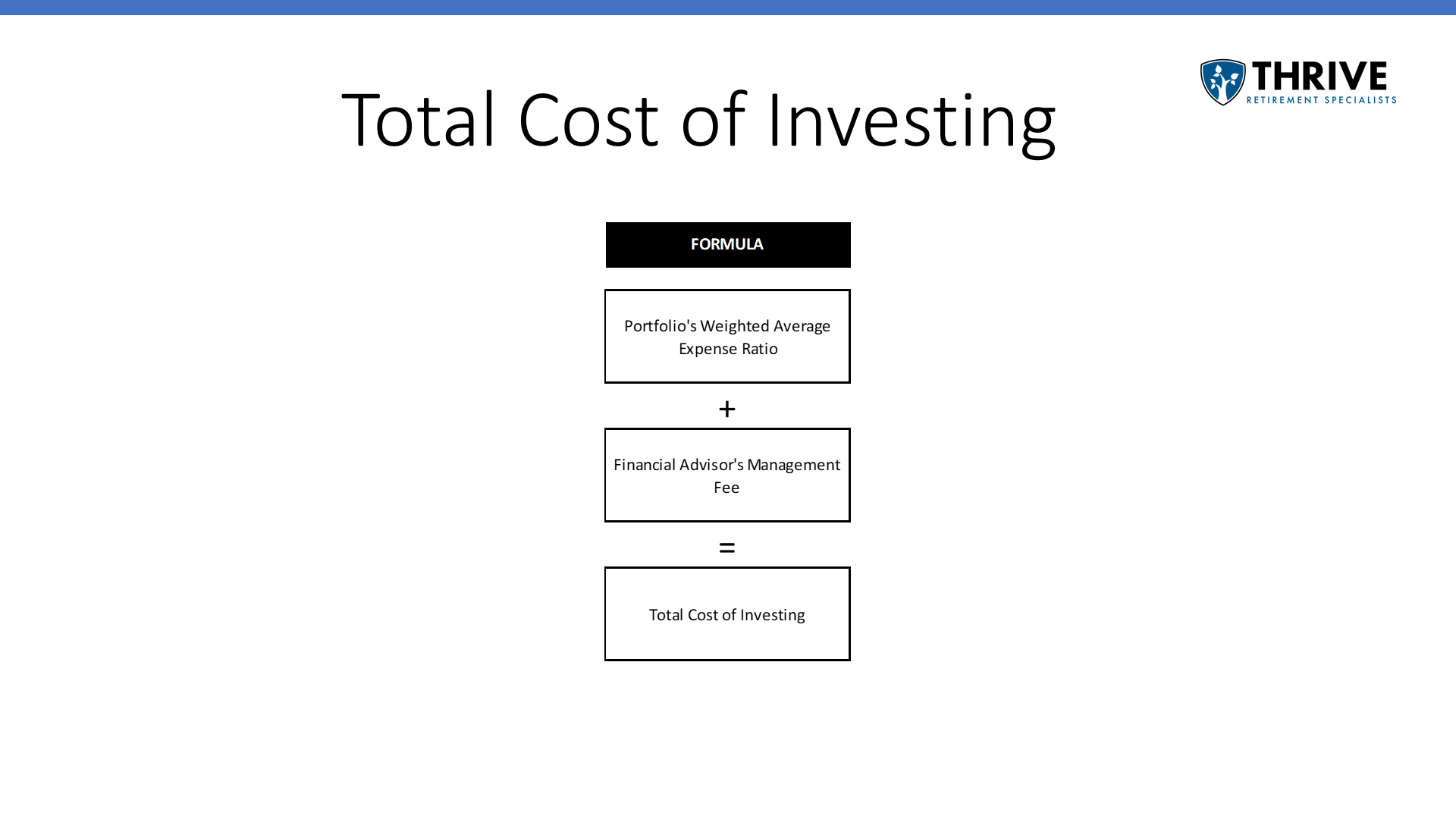

Total Cost of Investing Formula

The formula is easy. There are only two components needed to calculate your total cost of investing. The first is your portfolio’s weighted average expense ratio, and the second is your financial advisor’s management fee (if you even use one).

Every mutual fund or exchange-traded fund you hold in your investment portfolio charges what’s known as an expense ratio. This fee is not an explicit charge per se that you pay; rather, it is a portion of the return held back by the fund company to pay their expenses. Except for Vanguard, these fund companies are for-profit entities. These expense ratios can be as low as 0.02% or as high as 3.00% or more in some cases, and these fees can end up taking a massive bite out of your return. To figure your weighted average expense ratio, you will need to look up each holding you have in your portfolio and its weight within your portfolio. You can then calculate your weighted average.

The next component is your financial advisor’s management fee (again, if you have one). I believe that a good qualified financial advisor can add tremendous value to their clients in many ways, but the price you pay for that value can vary greatly. Do not be embarrassed if you do not know. Most financial advisory firms do all they can to not remind you of the fee they are taking. If you do not know, pick up the phone and call your advisor to ask how they are compensated and how much your fees have been. Do not accept anything less than a clear answer that you understand. If your advisor work’s under a Registered Investment Advisor (RIA), you can search for the firm’s Form ADV that must be filed with their state or the Securities Exchange Commission (SEC) at www.Advisorinfo.sec.gov. Compensation is required to be disclosed, among many other material items you may find interesting.

Don't engage an advisor before reading this .

Download our complete step-by-step guide to choosing a financial advisor .

Magnitude of Value Creation

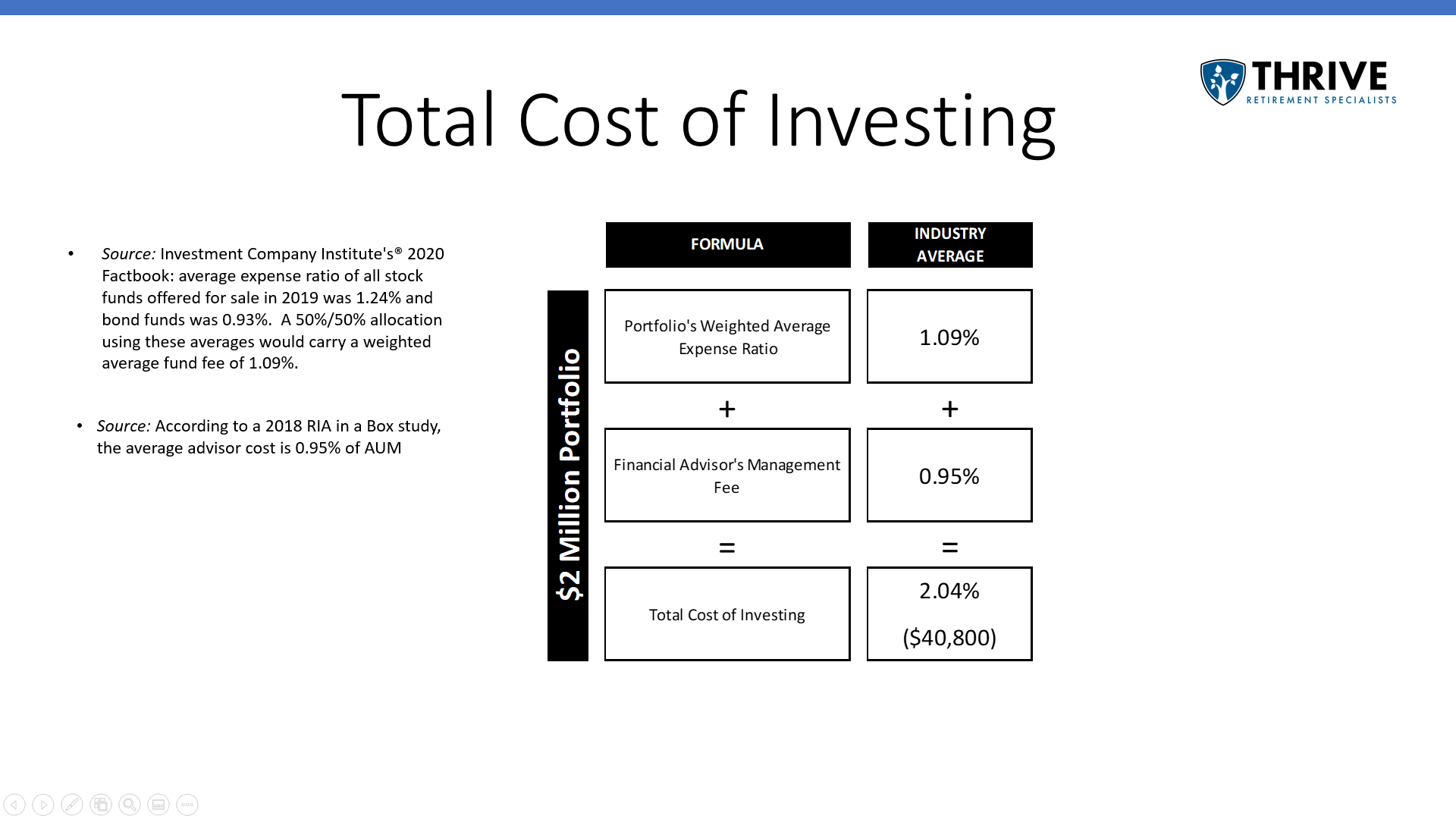

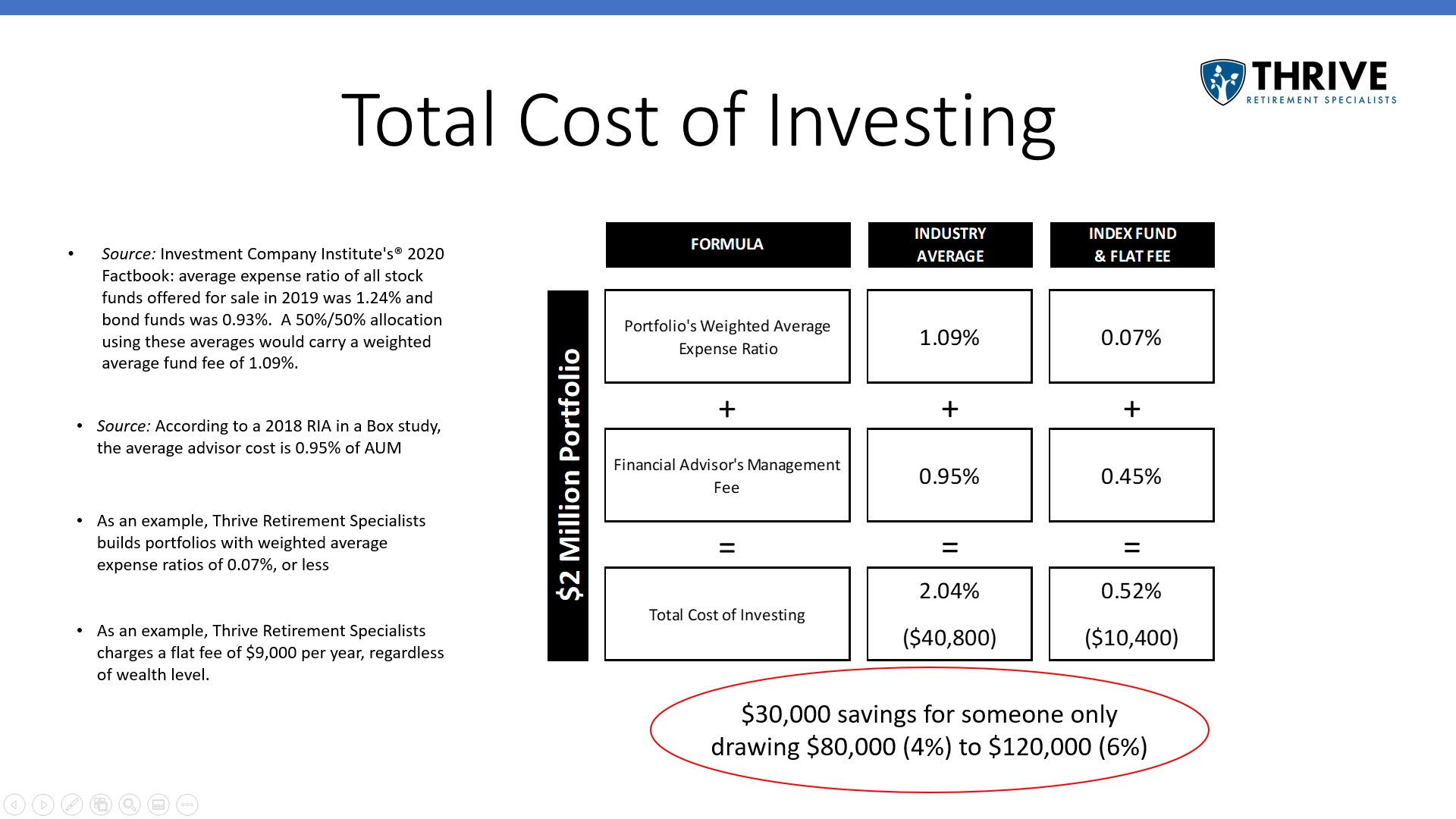

Is this exercise even worth it? Let’s take a look at an example. Let’s say a couple has a $2,000,000 portfolio, and we use industry averages to represent the two cost components. We will look to data published by the Investment Company Institute’s 2020 Factbook for the first component. Their data shows the average expense ratio of all stock funds offered for sale in 2019 was 1.24%, and the average for all bond funds was 0.93%. Based on these averages, a 50% stock and 50% bond portfolio would carry a weighted average expense ratio of 1.09%. For the next component, we will look at RIA in a Box’s 2018 study. Their study found the average advisor that charges on a percentage of assets under management basis, which is, unfortunately, a norm in the industry, charges 0.95%. So altogether, this person with a $2,000,000 portfolio at industry average cost components would have a total cost of investing of 2.04% per year, translating into an expense of $40,800 per year. Remember, this is just industry average, meaning half of the people out there pay more.

Let’s contrast this example with someone who decides to use low-cost index funds to build an investment portfolio and employs a financial advisor that charges a flat fee. As a proxy, I will use my firm for the example. We use only nine index funds, each representing an asset class that we believe a retiree should have exposure to. Through those nine funds, we build maximally diversified portfolios that give our clients exposure to approximately 30,000 securities across all investable 44 countries, all for a weighted average expense ratio of 0.07% or less. We charge all clients a flat fee of $9,000 per year (for ongoing retirement planning and investment management), but still, given a person had a $2,000,000 portfolio, that translates into 0.45% of the portfolio. So, altogether, the total cost of investing for this hypothetical person would be only 0.52% or $10,400 per year for a significant savings of over $30,000 per year! This is a huge savings for someone that may only be drawing $80,000 to $120,000 from this portfolio every year, assuming a 4% to 6% withdrawal rate.

We stand by ready to help if you need assistance reassessing your investment portfolio. If you have any questions, please feel free to reach out.