The Tradeoffs of 3 Popular Retirement Withdrawal Strategies

Key Takeaways

- The best withdrawal strategy supports the type of life you want to live in retirement.

- Some of the most popular withdrawal strategies (total return with rebalancing, bucketing) lead to unnecessary sacrifices, like delaying retirement and underspending, which are at odds with many retirees' desires.

- Guardrails are a better alternative for retirees who want to maximize their spending, especially during early retirement.

If you are like most retirees, you believe maximizing joy and fulfillment while avoiding unnecessary sacrifices are the primary goals of retirement planning. As retirement planning specialists, we help individuals craft and leverage strategies that serve these goals.

Retirement withdrawal strategies are one of the key strategies that must be considered when planning for a financially sustainable retirement.

Of the myriad of strategies that must be considered when thinking about retirement, arriving at a retirement withdrawal strategy that best helps balance underspending and overspending and protects against sequence of returns risk is one of the most consequential.

Here, we look at three popular retirement withdrawal strategies (also known as retirement drawdown strategies) that could help you plan for a more financially sustainable retirement. We also discuss how these approaches address the most critical risks in retirement, such as the sequence of returns risk and other challenges that may affect your long-term finances.

Can Managing Retirement Withdrawals Strategically Really Make a Difference?

Prior to retirement, many people wonder about how exactly they’re going to turn their retirement investment assets into an income stream. They research IRA withdrawal strategies, wonder how to withdraw from their 401(k), or seek guidance on how to optimize their pension fund.

Due to the lack of widespread information about retirement planning, many people simply aren’t familiar with the different types of retirement withdrawal strategies out there.

But choosing the right retirement withdrawal strategy can mean the difference between running out of money too soon versus enjoying your retirement to the max with the peace of mind of knowing that you have a plan to ensure your withdrawals are sustainable throughout the rest of your life.

Total Return with Rebalancing (the Conventional Way)

The workhorse for financial advisors and DIYers alike, this is the retirement withdrawal strategy that likely comes to mind first. This strategy chooses an optimal retirement asset allocation (typically a mix of stocks and bonds) based on a retiree's goals and risk profile.

Systematic withdrawals (e.g., monthly, annually) from the portfolio, often based on maintaining a “safe withdrawal rate,” are funded by a combination of income, capital gains, and principal.

The portfolio is rebalanced back to the target asset allocation on a predetermined basis, such as quarterly or annually, by selling investments that have grown in value and reinvesting the proceeds in the investments that haven’t.

As far as retirement strategies go, this one is easy to implement and delivers a predictable retirement “paycheck” because it is often based on a static withdrawal rate.

It also captures the benefits of rebalancing, a forced mechanism to sell high and buy low consistently—the hardest thing to do as an investor. It’s no surprise that this strategy is ubiquitous.

Despite its benefits, this approach has a significant flaw: it overly relies on asset allocation as the lever to control the sequence of returns risk.

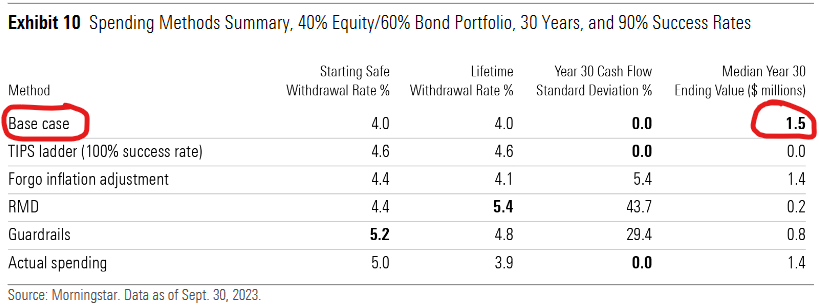

While it can be effective, it requires conservative asset allocations paired with static “safe” withdrawal rates, which tend to lead to underspending in retirement. This can be seen in Exhibit 10 from Morningstar, which shows that the “Base Case” method (total return with rebalancing) resulted in the highest ending portfolio balance of all the strategies tested.

The takeaway is that this approach is a great way to maximize the inheritance for your heirs, but it’s not the best way to maximize the joy derived from your wealth while living, say through travel, shared experiences, and gifts.

Pros

- Easy to implement

- Predictable retirement paycheck

- Maximize legacy

Cons

- Overly reliant on asset allocation to control risk

- Leads to underspending

Bucket Strategy (or Time Segmentation)

The bucket strategy is a retirement withdrawal strategy that allocates money based on asset-liability matching. This means matching future investment sales with planned expenses. Generally, there are three “buckets,” which can be separate investment accounts. As with all strategies, there’s leeway in how they’re designed.

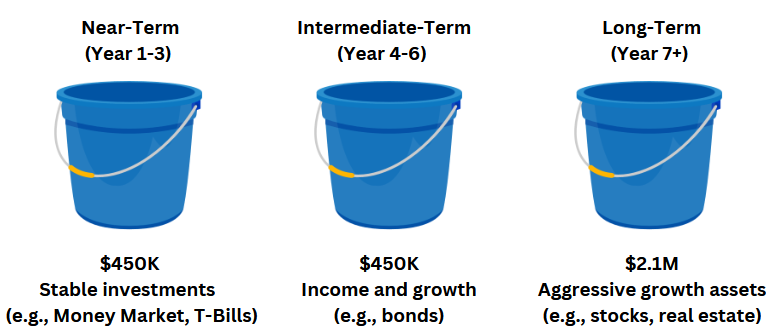

Here is an example of how a retiree with a $3M investment portfolio could allocate their account if they planned on withdrawing $150k annually.

The near-term bucket would have the first three years of retirement spending invested in stable investments, like a money market fund and treasury bills.

The intermediate-term bucket would have the next three years of spending in investments that provide income and growth, like bonds.

And the long-term bucket would be designated for spending needs seven years out and beyond, invested aggressively for growth in stocks and real estate.

A big benefit of bucketing is that it’s easy to understand and plays nicely with our human tendency to mental account. This helps retirees feel comfortable spending, which can be challenging during early retirement and heightened market volatility.

It’s also customizable based on preferences (e.g., the near-term bucket can be extended to five years of spending for the risk-averse), and having a near-term bucket helps mitigate the sequence of returns risk.

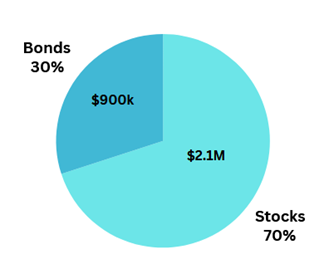

But does bucketing help retirees avoid making unnecessary sacrifices? We don’t think so. First, bucketing is total return in disguise; if we add the buckets in our example, we get a 70/30 asset allocation. So, it also tends to result in underspending.

Second, it adds complexity to the rebalancing decision, as rules need to be created to “refill” the buckets. If they’re not, your investment portfolio becomes increasingly aggressive as you spend down your near and intermediate-term buckets. And since rebalancing calls for selling growth assets to buy stable assets, some of the benefits of traditional rebalancing, where assets are sold based on how they have appreciated in value relative to other portfolio assets, can be lost.

Pros

- Mental accounting – helps retirees feel comfortable spending

- Can be tailored to your unique preferences

- Near-term bucket does a good job mitigating the sequence of returns risk

Cons

- Total return in disguise (with more work)

- Adds inefficiencies to rebalancing, which can diminish the likelihood of consistently selling high and buying low

- Can result in overly aggressive portfolios (more volatility)

Guardrail Retirement Strategy

The last of these three retirement withdrawal strategies, the guardrail retirement strategy is one that combines flexible spending with the asset allocation decision, helping you better control for sequence of returns risk.

In its simplest form, guardrails employ flexible spending rules based on retirees’ willingness to adjust their spending according to their investment portfolio performance.

Click here to learn more about two general approaches to the guardrail withdrawal strategy that you can employ and the pros and cons of each, based on the experience of our retirement planning specialists.

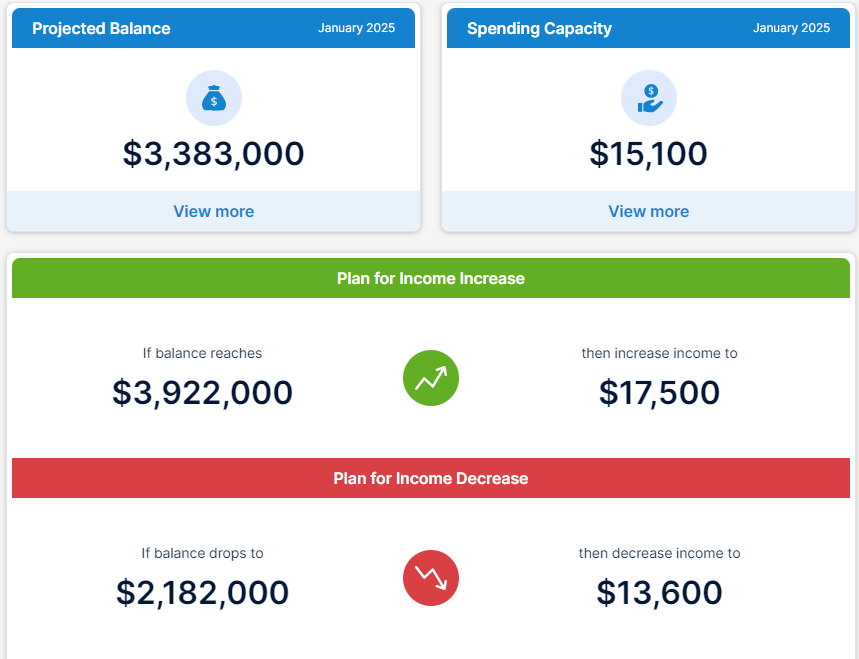

For example, this retiree’s plan allows for a $15,100/month spending capacity from a $3.38M investment portfolio (a 5.4% withdrawal rate!) as long as they follow the plan for income increases and decreases.

By withdrawing more during good times and less during bad times, retirees can spend more from their investment portfolios throughout their lifetime than with other withdrawal strategies. This works very well for retirees who want to spend earlier in retirement on things like travel while they’re still physically able.

Exhibit 11 shows how Guardrails provides a higher safe withdrawal rate across most asset allocations compared to other withdrawal strategies (including the Base Case/total return with rebalancing).

But, like the above retirement withdrawal strategies, this strategy has some drawbacks. Namely, it requires spending flexibility, which creates cash flow volatility (but typically not much by design). It also leads to lower ending portfolio values since you spend more during your lifetime, which isn’t the best if you value maximizing the legacy for your heirs.

Pros

- Intuitive – people naturally “tighten their belt” when needed

- High initial safe withdrawal rate and lifetime spending compared to other strategies

- Mitigates sequence of returns risk better than asset allocation alone

Cons

- Cash flow can fluctuate

- Low ending portfolio value (due to more lifetime spending)

- Hard to DIY

Integrating Withdrawal Strategies into Your Retirement Plan

It should go without saying that the withdrawal strategy you choose should support the life you want to live in retirement. But surprisingly, many retirees settle for retirement withdrawal strategies that cause them to make unnecessary sacrifices, like underspending, delaying retirement, or both.

While each strategy has its own merits, the best choice depends on your personal circumstances, including current savings, desired lifestyle, and risk tolerance. Here’s a summary of each:

- Conventional Total Return: If you value predictability and aim to maximize the amount left for heirs, this method may suit your goals.

- Bucket Strategy: If you prefer a more segmented approach that associates funds with periods of time when you plan to need the money, this option can help manage spending without severe impacts from market swings.

- Guardrail Retirement Strategy: For those who need flexibility and wish to adjust spending in response to market performance, the guardrail retirement strategy might provide the balance between immediate comfort and long-term sustainability.

If you want help crafting a retirement withdrawal strategy to improve your retirement plan, we are here to help. You can click here to schedule an informal, introductory Zoom call with one of retirement income planning specialists to get started.