What is Your Retirement Spending Capacity?

(READ TIME: ~5 MIN)

TAKEAWAYS:

- Retirement Spending Capacity is a far more meaningful measure than conventional retirement planning's probability of success/failure.

- Retirement Spending Capacity can show you what tradeoff decisions mean to you in dollars and cents and allow for greater planning control.

- Retirement Spending Capacity enables you to make the most of your resources at all times while also reducing the risk that you could run out of money.

Conventional retirement planning fails to answer the fundamental question, “What is your retirement spending capacity?” or, in plainer terms, how much can you afford to spend in retirement? Rather, conventional retirement planning forces you to throw out a level of spending you would like to sustain (which you are probably still trying to figure out), so it can tell you the probability of not running out of money. How does this even help really? Having a 90th percentile probability of success, for instance, tells you nothing. What do you need to do if you happen to fall into the other 10th percentile? Is this too conservative, meaning you can or should increase what you plan to spend? What if you run this plan one year later after a 20% stock correction or 20% rally in the stock market? How different would the answer be then? What if you were to cut your spending some when the markets fall – would that do the trick?

Solve Instead for Retirement Spending Capacity

If you solve instead for your Retirement Spending Capacity, you are given an answer that makes sense. For instance, given your assets, income sources, risk tolerance, longevity, and willingness to be flexible in your spending, your spending capacity is $18,000 monthly after taxes. This is a meaningful measure you can understand. You can compare this measure against what you think you want or need to spend in retirement and reconcile if necessary.

Further, you can explore a range of spending capacity outcomes by altering your assumptions. Instead of increasing or decreasing a non-sensical probability of success measure, you can see what various tradeoff decisions mean in terms of actual dollars and cents. Retirement Spending Capacity gives you greater control and the ability to fine-tune a plan until it is just right for you.

Retirement Spending Capacity Updates in Real-Time

We all know the amount we can spend in retirement will be greatly influenced by economic and market factors such as inflation, interest rates, and stock valuations. We also know that we cannot know in advance what our path of returns will be. This is why the dispersion of possible outcomes in conventional retirement planning is so wide. A suitable range of possible outcomes may be something like running out of money ten years too soon or passing away with $10 million. Quite a difference!

Retirement Spending Capacity does not leave you with a wide dispersion of possible outcomes because it adapts in real-time. Retirement Spending Capacity is an ongoing, dynamic calculation that considers changes in economic and market factors as they happen. Instead of probability of success being the changing variable, your Spending Capacity becomes the changing variable. If markets do better than expected, your portfolio will grow ahead of forecast, meaning an increase in spending capacity is warranted. If markets do worse than forecast, your portfolio will not have enough assets to support your spending capacity and require a decrease (absent other change).

Retirement Spending Capacity enables you to make the most of your resources at all times while also reducing the risk that you could run out of money. In good times, it shows you can spend more; in bad times, it shows you can spend less. But it shows you how much more or how much less based on what is actually happening! For those who want to make the most of their retirement while living and can do so, this approach is preferential to conventional planning’s approach of not making adjustments and seeing where you land between running out of money ten years too soon or passing away with $10 million.

Retirement Spending Capacity in Practice

In the following example, this couple is retired and has a current portfolio value of $4,532,000. Based on this couple’s portfolio value, incomes, risk tolerance, longevity, and willingness to be flexible in their spending, their Retirement Spending Capacity is $19,600 per month (or $235,200 per year) after taxes.

We can further see that if their portfolio’s value climbs to $5,145,000 (+14%), they get a $2,600 monthly increase to make their spending capacity $22,200 per month. However, if the portfolio were to decrease to $2,681,000 (-41%), their spending capacity would be reduced by $2,000 monthly to $17,600 per month.

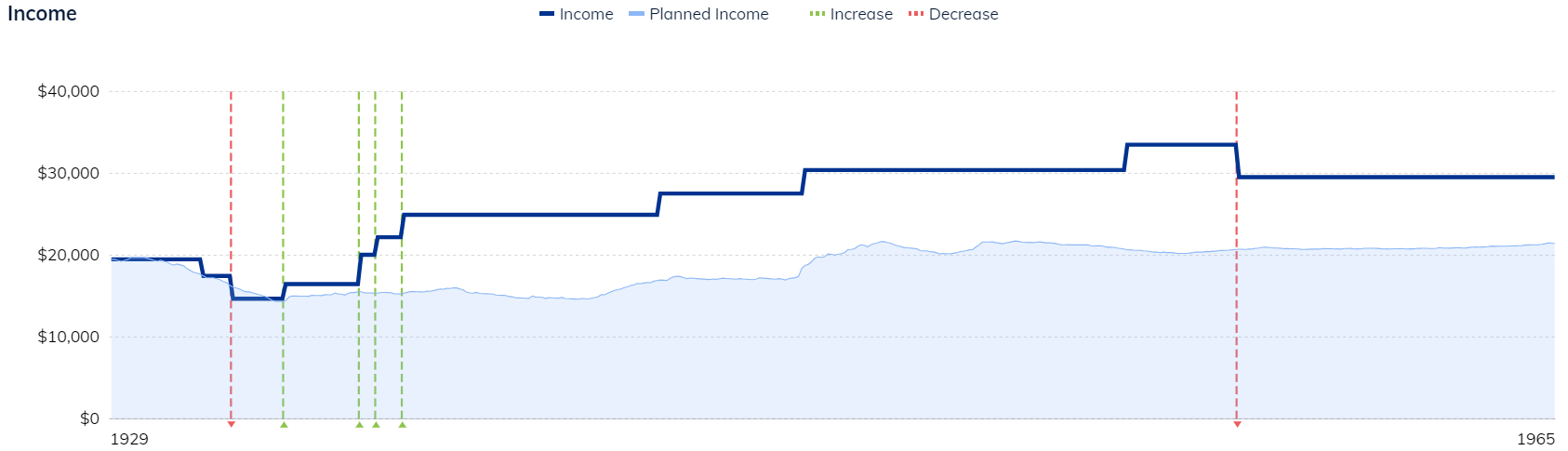

These higher and lower portfolio values are this couple’s risk-based guardrails, and they ensure the couple stays on track – increasing spending when times are good and decreasing spending when times are bad. These guardrails and levels of change are fully customizable. Back-testing this couple’s plan during the Great Depression shows us how Retirement Spending Capacity and Risk-Based Guardrails function together over time:

As long as the portfolio value (the dark blue line) stays between the lower risk-based guardrail (red line) and the upper risk-based guardrail (green line), no change is required. If the portfolio value exceeds one of the lines, an increase is warranted (dashed green vertical line), or a decrease is required (dashed red vertical line).

This couple would have started with a Retirement Spending Capacity of $19,600 in 1929 and ended with a Retirement Spending Capacity of $29,600 in 1965 after having some decreases and increases along the way:

If you would like to determine your Retirement Spending Capacity, we are here to help. You can click here to schedule an informal, introductory Zoom call to get started.