Why Your Retirement Planning Shouldn’t Be Based on Pass or Fail

We’ve always found it odd that traditional retirement planning focuses on the probability of success or failure. The retirement planning services industry has used this language and methodology for so long that most people have grown accustomed to and do not question the approach.

Traditional models that only focus on the probability of success versus failure imply that if you don't hit a particular number, you risk “failing” retirement. However, the idea that retirement is a binary outcome simply does not hold up in real life.

How are you supposed to react if you are told you have a 90% probability of success and a 10% probability of failure if you take a certain amount of inflation-adjusted income for some assumed time frame from an investment portfolio given a certain asset allocation between stocks and bonds? In traditional retirement planning, this 90% probability of success measure is generally interpreted as being associated with a conservative retirement plan. But still, can you really afford to take a 10% risk of “failing retirement”? Is failing at retirement even an option? Of course not.

In this article, we explore how moving away from a static pass/fail framework toward one that emphasizes spending capacity can yield better outcomes.

You Can Make Changes to Your Retirement Planning Strategy

As retirement planning specialists, one of the biggest issues we have with traditional retirement planning models is that they assume that you cannot make changes over the course of a 30+ year retirement. This extreme simplifying assumption sounds pretty absurd when you say it out loud, and we know it does not reflect reality.

In reality, all it often takes to avoid “failing retirement” is a slight change in spending. If this is true, shouldn’t the focus of retirement planning be on identifying when and how much of a change to your spending may be needed so that your retirement plan can always remain on track and not run the risk of failing?

Further, if your actual experience ends up being better than one of the extreme downside possible scenarios, shouldn’t you be able to increase your spending as your retirement plan becomes less risky over time so you can enjoy more of life? Learn more about how to determine your retirement spending capacity here.

"Reality-Based" Retirement Planning Answers the Right Question

By taking the same powerful Monte Carlo simulation tools and traditional retirement planning equation and changing the variables, we can instead solve for spending capacity and then determine a set of total risk-based guardrails (or spending rules) for your retirement withdrawals.

In other words, assuming a portfolio balance, income, risk tolerance, retirement length, and asset allocation, we can answer the question of how much you can spend given a certain level of willingness and ability to make changes to that spending if required. Further, we can find portfolio balance levels where spending can be increased or would need to be decreased to stay on track.

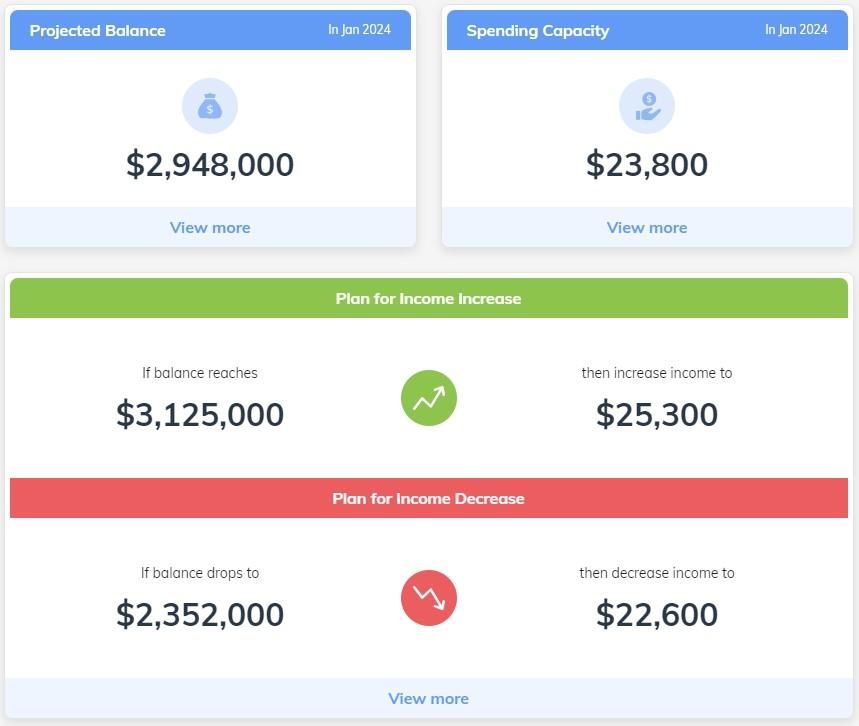

To better illustrate how this “reality-based” approach to retirement income planning works, let’s look at an example. . Following are the results of a hypothetical couple planning to retire in January of 2024:

Given the couple’s current portfolio balance of $2,948,000, expected income, asset allocation, risk tolerance, and time horizon, they can start by spending $23,800 monthly (after taxes). If their portfolio climbs to $3,125,000 (+6%), their risk level reduces to a point where they can increase their spending by $1,500 to $25,300 per month. Alternatively, if their portfolio falls to $2,352,000 (-20%), their risk level increases to a point where they need to decrease their spending by $1,200 to $22,600 monthly to bring the plan back into balance. As retirement planning specialists, this dynamic approach is one that we believe is more realistic and leads to better overall outcomes for retirees.

Conventional Retirement Planning Can Not Adapt

Traditional retirement planning makes a one-time forecast and yields a probability of success or failure. The traditional approach makes no effort to incorporate actual data as it unfolds, nor does it tell you what action to take or when it is needed.

Our “reality-based” approach to retirement income planning instead calculates spending capacity and total risk-based spending guardrails to guide essential adjustments to spending in response to changes in the portfolio value and the realized sequence of portfolio returns.

"Reality-Based" Retirement Planning Leads to Better Economic Outcomes

Not only does utilizing flexible spending rules make sense intuitively. It also makes sense economically and leads to a more optimal retirement outcome. Taking a flexible (or dynamic) approach to spending (or withdrawals) allows you to start with a higher income level and tends to lead to a higher cumulative retirement income over time.

In his research article entitled “A Framework for Assessing Variable Spending Strategies,” Wade Pfau, Ph.D., CFA, RICP® concludes that variable spending strategies can dramatically increase sustainable retirement spending. He further found traditional retirement planning’s constant inflation-adjusted spending until wealth depletes approach to be the worst possible strategy.

We have also written numerous articles about flexible spending rules (aka dynamic withdrawal rules) and have long felt applying dynamic withdrawal rules is one of the most powerful tools available to maximize the retirement income a client can collect during their living years. Our latest, entitled “Quantifying the Value of Dynamic Withdrawal Rules,” is a case study that shows the quantifiable value of applying flexible spending rules to a retirement plan.

If you would like to better understand how the solutions discussed above can help you, we stand by ready to help. To learn more, you can schedule a friendly, informal call with one of our retirement planning specialists here.