Dynamic Withdrawal Rules -- Higher Withdrawals With Less Risk

Key Takeaways:

- Rigid withdrawal rules like the “4% rule” are based on worst-case historical scenarios and often result in retirees underspending and missing out on potential quality-of-life improvements.

- Dynamic withdrawal strategies allow for adjustments based on market performance, which can increase lifetime income and reduce the risk of running out of money.

- With proper boundaries and ongoing planning, dynamic withdrawals offer higher starting income and greater flexibility, leading to both higher success rates and more enjoyable retirements.

Most retirees assume they need to stick with a rigid withdrawal rate to protect their nest egg. But suppose you could allow yourself a little flexibility in your retirement spending plan. In that case, the application of dynamic withdrawal rules could materially increase the amount of money you could withdraw from your portfolio over your lifetime while actually decreasing your risk at the same time.

As retirement planning specialists, we’ve seen many retirees leaving hundreds of thousands of dollars on the table because of following certain rules too rigidly. So in this article, we explore why the traditional 4% rule falls short, how dynamic withdrawal strategies work, and how they could help you maximize quality of life in retirement without sacrificing your financial security.

The Problem With William Bengen's "4% Rule"

Let’s start with a little history lesson for context around why some retirement experts recommend sticking to a certain withdrawal rate in retirement. In 1994, William Bengen published his study “Determining Withdrawal Rates Using Historical Data” in the Journal of Financial Planning. It is important to note that the point of Bengen’s study was not to find what an optimal withdrawal rate would be for a retiree. Rather, the point was to study what would have been the highest sustainable initial withdrawal rate, with inflation adjustments a retiree could have taken assuming a 50% stock (S&P 500) and 50% bond (intermediate-term government bonds) portfolio over thirty rolling thirty-year periods starting in 1926. Bengen found the worst-case scenario occurred in the thirty-year period starting in 1966, where this hypothetical retiree would have only been able to take a 4.15% initial withdrawal rate.

This is where the “4% rule” came from, much to Bengen’s chagrin. Jumping to the conclusion that 4% must be the only safe withdrawal rate in retirement ignores the other 29 periods where this hypothetical retiree could have withdrawn a lot more from their portfolio (over 8% in the periods starting in the early 1980s and somewhere between 4% and 8% in all other periods). Following the “4% rule” in all periods, except for the one starting in 1966, would have led to a lot of money remaining on the table upon passing beyond what was planned. That is money that could have been used to maximize happiness and contentment while living.

The “4% rule” presumes that retirees cannot make adjustments—which is just not true for most retirees. The level and degree to which a retiree can make adjustments will differ given each retiree’s unique situation, but most times, there is at least a little room to make adjustments if required to do so.

Modeling a Hypothetical Retiree Following the "4% Rule"

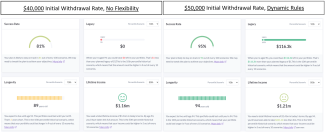

Let’s take a look at an example of the 4% rule at work using a hypothetical retiree. This retiree is a single, 65-year old retired male with a $1,000,000 portfolio invested in a generic 50% stock and 50% bond portfolio. This gentleman wants to take a $40,000 (4%) initial withdrawal from his portfolio and have the withdrawal adjusted for inflation annually thereafter. Aside from inflation adjustments, this person does not want to make any other changes to his withdrawal from year to year. Using our specialized retirement income planning software, we can see the results as follows:

This person has an 81% probability of accomplishing his retirement goal, meaning that out of every 100 scenarios, this person is likely to be successful in 81 of them. Further, looking at the 10th percentile of observations, you can see this person’s portfolio would only last to the age of 89, 5 years short of their forecasted life expectancy of 94. Similarly, looking at the 10th percentile of observations, this person will not have any money left in his portfolio by the end of his retirement at age 94. At the 50th percentile, or median observation, this person would have enjoyed $1.16 million of lifetime income.

What Does Success Rate Mean?

Let’s look into this success rate more. (Click here to learn why your retirement planning shouldn’t be based on a pass or fail and the role success rates play in your retirement projections).

Here are all the observations based on over 1,400 observations using actual historical results over the past 118 years (a slight improvement over the Monte Carlo approach because markets do not behave entirely randomly):

This hypothetical retiree’s worst-case observation, indicated by the red line, represents a retiree that would have retired starting in October 1905. If this hypothetical retiree were to experience the same path of returns as someone starting retirement in October 1905, he would run out of money at age 83 years and 10 months. The best-case observation indicated by the green line represents a retiree that would have retired starting in March 1982. If this hypothetical retiree were to experience the same path of returns as someone starting retirement in March of 1982, he would pass having $4.18 million (in real dollars, accounting for inflation the amount would be even more) left at age 94. There are considerable disparities in these observations, but unfortunately, you can not know your particular path in advance. It is likely to be somewhere in between these observations.

How can you be conservative if your path ends up not being as favorable but still allow yourself to participate in the upside if your path ends up being more favorable? This is where dynamic withdrawal rules come into play.

Applying Dynamic Withdrawal Rules

When trying to find the best retirement withdrawal strategies to optimize for both sustainability of income and quality of life, we suggest looking to dynamic withdrawal rules.

Dynamic withdrawal rules are highly customizable to an individual’s situation and comfort level. They allow for small changes to be made along the way, avoiding the need to make potentially disruptive lifestyle changes later in retirement suddenly. Retirement planning is not a static event. It should be a dynamic, ongoing process, so you balance minimizing risk with maximizing quality of life. Dynamic withdrawal rules help you to do this by setting boundaries to reduce spending if your withdrawal rate gets too high and reduce spending if your withdrawal rate falls.

Let’s apply a simple boundaries rule to this hypothetical retiree. Since this person is now willing and able to be flexible, let’s go ahead and start with a $50,000 (or 5%) initial withdrawal amount and have it still adjust for inflation. Our boundaries rules are set as follows:

For the next 30 years, if the withdrawal amount ends up representing more than 6% of the portfolio, this retiree will reduce his withdrawal amount by 10%. On the flip-side, if the current withdrawal amount represents less than 4% of the portfolio, the retiree will increase the withdrawal amount by 10%. This assessment will be made at the end of every year, and changes made accordingly. Also, while this person has some flexibility, they still need some minimum income to cover essential living expenses, so a floor is set at $30,000.

Let’s take a look at how this hypothetical retiree’s plan changes:

Starting with a higher, 5% withdrawal rate instead of 4%, you are still able to increase your probability of experiencing a successful, positive outcome while taking less risk. The success rate goes from 81% to 95%. Now at the 10th percentile of observations, this portfolio will still last this retiree through his projected age of 94. In fact, at the 10th percentile, there is still $116k left in today’s dollars.

At the 50th percentile observation, this retiree will be able to enjoy $50,000 more. And this is just at the median observation. While not shown, if the person experienced an 80th percentile observation path, lifetime income would be $1.80M. Following the “4% rule”, the retiree would never experience a lifetime income of anything more than $1.16M. This is $640k more income one could enjoy while living.

Again, you have no way of knowing what the future holds, but adapting to whatever the path is the key to maximizing your potential outcome. You may be able to be a lot more flexible in your spending than you realize with some proper retirement planning. See our comprehensive “Guide To A Proper Retirement Planning Process” to learn more.

If you’d like help with determining the optimal retirement withdrawal strategies for your situation, you can schedule a complementary call with one of our retirement planning specialists here.