Evaluating the Big Five Retirement Risks Every Retiree Faces

Retirement risks represent the possible events that could occur and get in the way of living your ideal life in retirement.

More Than Just Investment Risk

Through my experience, I have found most advisors and individuals have a good grasp of only one such retirement risk: Investment Risk. Most understand the concept of risk versus return and the need to select an asset allocation of stocks and bonds in an investment portfolio such that the performance variability does not exceed that which is palatable to the client. Otherwise, the client runs the risk of aborting on their plan at an unfavorable time (typically when markets are lowest), causing irreparable harm to their investment portfolio. Unfortunately, this is typically where most conversations about risk begin and end.

The very act of retiring subjects a retiree to five unique risks:

- Spending Risk

- Sequence-of-Returns Risk

- Purchase Power Risk

- Longevity Risk

- Investment Risk

Each of these risks is material and pose a potential threat to your retirement plan. It would be best if you took the time to understand each of these risks and assess your feelings toward each. Before explaining each risk, we need first to explore how to evaluate risk.

Willingness and Ability to Accept Risks

Risk Tolerance is your level of willingness to take a risk. You may feel averse to one type of risk for whatever reason but find another type of risk completely acceptable. On the other hand, risk capacity is the level of your ability to take a risk. Once you understand your willingness to take a risk, you must check that against your ability to take a risk. Your ability to take risk overrides your willingness to take a risk. Even if you are willing to take more risk than you have the capacity for, you will be constrained by your risk capacity. You cannot bet what you cannot afford to lose.

Big Five Retirement RisksTM

Following are descriptions of each of the five unique retirement risks:

1). Spending Risk

Spending risk is not just the risk of spending too much; rather, it is the risk of inaccurately projecting the amount of income you will need throughout your retirement. It is not hard to imagine how easy it would be to miscalculate this projected income need when considering that a retiree is projecting this need far into the future to cover expenses that fall into one of the following three categories: 1) fixed living expenses, 2). discretionary expenses, and 3). contingent expenses. Further, all these expenses are continuously magnified by an unknown rate of inflation throughout your retirement years. The odds are that you will not be successful in projecting your income needs precisely.

There are three sources of spending risk: 1). overspending, 2). "shock" spending, and 3). underspending. Overspending is spending more than you projected in your retirement plan. Overspending could cause you to deplete your retirement assets prematurely. "Shock" spending is that inevitable unplanned expense that pops up unpredictably. It could be foundation damage on your home that requires $40,000 to fix, a change in public or tax policy, or emergency help to a friend or family member. Whatever the cause, the expense was not planned for and was unpredictable. Underspending is the risk of sacrificing quality of life during your retirement when it was not necessary. You are given but one life to live, and it should be lived with a feeling of confidence and empowerment to live in a way that you find most fulfilling. You should not sacrifice quality of life and joy while living due to the fear of running out of money only to pass, leaving a much larger than planned legacy gift to family or the community. There is a balance to be struck here, but far too often, retirees are so driven by the fear of running out of money they forget to enjoy the life they are living.

2). Sequence-of-Returns Risk

Sequence-of-returns risk is the risk that a series of poor returns early in your retirement years can have an exponentially negative effect. Sequence-of-returns risk is a serious threat because retirees do not have as much time to make up for losses that are compounded when simultaneously taking income distributions. When you withdraw money from an investment portfolio, negative returns early in retirement can cause the portfolio to fall faster than if those same negative returns instead occurred later in retirement.

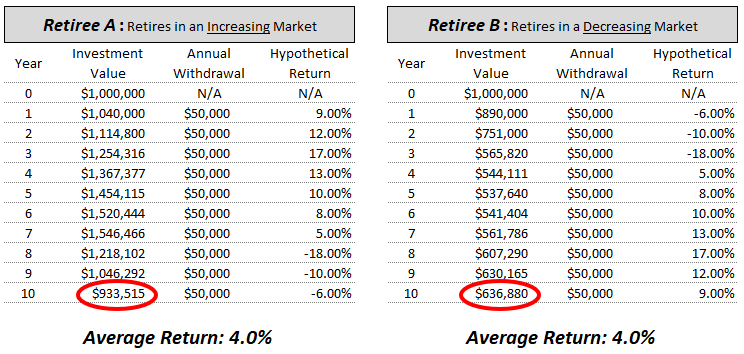

As an example, assume you have two retirees, A and B. Both retirees start with $1,000,000 investment portfolios, take $50,000 annual withdrawals, and earn the same average annual return on their investment portfolios of 4.0%. The only difference is in the ordering of the hypothetical annual returns. Retiree A starts his retirement when he is blessed with a series of positive market returns followed by a series of negative returns later. Retiree B starts his retirement at the beginning of a market downturn and suffers a series of negative market returns right away, followed by positive returns later. [Note - the returns are the exact same returns in opposite order]

Retiree B ends up with almost $300,000, or 32%, less than Retiree A even though they had the same average return of 4.0% over the 10-year period. This example illustrates the unfortunate power of sequence-of-returns risk. The randomness of market returns matters a great deal at the beginning of retirement because portfolios are large, and a given percentage change has a more significant impact on absolute wealth.

The level of sustainable withdrawal rate from an investment portfolio is heavily influenced by what happens in the early part of retirement. As a result, actual wealth accumulations and sustainable withdrawal rates will vary substantially among retirees. Some retirees will be able to spend more aggressively than others based on the luck of the market returns they experience in retirement. These investment market-driven outcomes are unpredictable. Sequence risk widens the distribution of possible outcomes in retirement.

3). Purchasing Power Risk

Purchasing power risk is the risk the value of a dollar, expressed in the number of goods or services it can buy, decreases over time due to inflation. While inflation typically only slightly increases the cost of goods and services from year to year, it can present a serious risk and challenge for retirement income planning, as its impact is compounded over an extended period. Given the ongoing advances in medical research, a retiree might plan for the possibility of a retirement that could last 30 years, 40 years, or more. Over this extended period, the steady erosion of purchasing power because of inflation could be materially damaging.

The goods and services one dollar could buy back in 1980 would only buy $0.32 worth today in 2020. As of the end of 2019, the 50-year average inflation rate (which includes the sky-high rates during the 1970s) as measured by the Headline Consumer Price Index was 3.9%. While having a history is excellent, the real challenge of building a retirement plan is in predicting what the level of inflation will be for you during your retirement years. The U.S. Federal Reserve believes the long-run rate of inflation will average approximately 2.0% per year according to its FOMC December 2019 forecast. While 2.0% may not seem like a lot, when compounded over 30 years, it represents a 45% decline in a dollar's purchasing power today.

Another trick to forecasting inflation is the rate of price increase does not affect all goods and services linearly. In other words, not all goods and services increase by the same rate of inflation. The rate of inflation can vary from country to country, from state to state, and across different goods and services. For example, historically, the cost of medical care has risen faster than average inflation, while food and clothing costs have risen at a slower rate. This means the actual rate of inflation a retiree experiences depends on how the retiree spends their income.

Learn the full retirement planning process.

Download our 8-Step Guide to Proper Retirement Planning.

4). Longevity Risk

Longevity risk is the risk you live longer than you planned for and possibly outlive your financial resources. While statistics do a great job of projecting the average mortality for the overall population of people, a single individual cannot know in advance whether they will live to an age below or above that statistical average. This problem only grows when you have a couple needing to plan for two projected life expectancies.

The mortality assumption, or planning horizon, is one of the critical assumptions made in retirement planning. Living beyond your planning horizon assumption, you run the risk of outliving your retirement savings. Not living to the end of your assumed planning horizon, you run the risk of underspending your retirement savings, leading to unneeded sacrificed quality of life during retirement and a larger than planned legacy at death. There is no one-size-fits-all answer about the appropriate planning horizon. The answer requires careful thought about whether it is reasonable to plan for more or less than statistically determined average life expectancies. Current health, family health history, and quality of health care may all be factors in helping you decide.

The chief determining factor will likely be your level of longevity risk aversion. Some retirees will be less longevity risk-averse and will choose to use a shorter planning horizon assumption so they can maintain a higher spending rate through retirement. Other retirees will be highly longevity risk-averse and will happily sacrifice some incremental spending during retirement to ensure that through specific tools and tactics, they do not outlive their savings.

5). Investment Risk

Investment risk is the risk that actual returns will differ from the expected return outcome at any point in time. No one knows with certainty what the future holds, so we look to the past to make observations about how certain asset classes performed. Taking specific note of each asset’s average return and the variability of return experienced around that average return, known as standard deviation. From these observations, one can typically make a reasonable long-term forecast of future expected returns.

Stocks have a higher potential for return but also higher variability in the path of return. In contrast, bonds have lower return potential but also less variability in the path of return. The greater the allocation to stock in the investment portfolio, the greater the expected return and the higher the investment risk you are taking. Some individuals can tolerate wider swings in their investment portfolios' performance in the search for higher returns, whereas some individuals cannot comfortably stomach such swings.

Dealing with the Big Five Retirement RisksTM in Retirement Planning

Hopefully, you now have a better understanding of the Big Five Retirement RisksTM that every retiree face. Much of a good retirement planning process is driven by and centered upon dealing with these risks. Every individual has a unique personal situation that leads to differing levels of exposure to these risks. Further, every individual has a differing level of feeling, or risk averseness, toward them. A proper retirement plan will seek to manage the risks to which you feel averse to a level you find palatable so that you can feel at ease and increase the probability of staying on course with the plan. To learn more on what to expect from a complete retirement planning process, please refer to Thrive Retirement Specialist’s “Guide to a Proper Retirement Planning Process.”

You took the time to understand each risk better and have contemplated your level of willingness and ability to accept each, but now what? Is there anything you can do to change your risk exposure profile? Fortunately, the answer is yes. Through a combination of certain tools, tactics, and further tradeoff considerations, there are ways you can change your risk exposure profile. This is the process of risk management. To learn more about tools and techniques that can be used to manage the Big Five Retirement RiskTM, please refer to Thrive Retirement Specialist’s Insight entitled “Managing the Big Five Retirement RisksTM Every Retiree Face.”

Do you have questions about retirement? We're here to help! Please feel free to reach out.