How to Build Your Optimal Investment Portfolio for Retirement

Key Takeaways

- Building a solid and diversified portfolio is essential to protecting against sequence-of-returns risk and securing a reliable income during retirement.

- Adopting a passive investment strategy focused on low-cost index funds can help maximize returns and minimize transaction costs, providing long-term growth without the stress of market fluctuations.

- Spread investments across various asset classes to reduce risk and ensure your portfolio’s stability over the long term.

Here's Why Investment Portfolios Should Look Different in Retirement...

If you’re like most people, your investment portfolio is probably one of the most important assets you’ll use to fund your retirement. As such, it is imperative that your investments are well-managed and that your retirement portfolio allocation matches your goals and risk tolerance.

No longer can you take the cavalier approach you once could when you were younger, saving for a time way off in the distant future. There is less time to rebound from mistakes now.

Here, we cover the basics of building your investment portfolio for retirement, starting with your investment philosophy and strategy, before diving into the best asset classes and funds to consider as you shift your portfolio to meet your retirement needs.

First Things First: Minimize Volatility and Fees

How should an investment portfolio look differently in retirement? First, volatility and fees should have a much higher weight as you consider different retirement investment strategies.

As sequence-of-returns-risk is highest early in retirement when the portfolio is largest, it’s essential to ensure your portfolio is well-constructed and diversified to minimize volatility. You may consider having a liquidity plan to pre-fund the first 18 months worth of income so you don’t have to sell off investments in a down market in case there’s a down market when you need to withdraw funds.

Second, because you cannot afford to take concentrated risks to try and hit home runs anymore, keeping as much return as you can becomes more critical. This means paying attention to fees that can eat away at your returns.

Unfortunately, most people aren’t aware of the impact that paying a percentage of their portfolio to their advisor can have on their portfolio and long-term investment returns. This is one of the reasons it may be a good idea to consider the alternative solution of engaging a flat-fee advisor to manage your portfolio.

Next, we’ll talk about an investment philosophy that can help you do both - minimize volatility and fees while building your optimal retirement portfolio allocation.

Adopt a Passive Investment Strategy

A passive investment strategy or philosophy embodies a long-term, strategic investment positioning that follows the tenets of Modern Portfolio Theory to minimize risk for a given level of return. This passive investment philosophy can also be referred to as index-based.

One of the main tenets of Modern Portfolio Theory is the belief that diversification offers the best protection against risk and that investment markets are efficient over time. A passive philosophy proponent does not believe it makes economic sense to attempt timing or outperforming investment markets. (Here’s how chasing performance can actually hurt your investment returns.)

Instead, someone who utilizes a passive investment strategy would seek broad-based exposure to desired asset classes by investing in low-cost index funds. After building a portfolio, they would review and rebalance the portfolio as necessary.

The Myths About Using a Passive Investment Strategy

Some dismiss passive investing because they mistakenly see it as a "do nothing" approach to investing. This belief could not be further from the truth.

There is no such thing as being completely passive when it comes to investing.

Forecasts of expected returns and risk factors must be created, asset classes must be evaluated for inclusion, efficient portfolios must be constructed, and index funds must be evaluated and selected. Additionally, a rebalancing strategy must be determined, the portfolio monitored, and trades executed upon when required by the selected rebalancing strategy.

As it relates to building your investment portfolio for retirement, the "passive" part of passive investing comes into play when reacting (or not reacting) to the market’s short-term ups and downs.

A passive investor believes investment markets are efficient over the longer-term and that it does not make economic sense to incur the extra costs of active management in an attempt to benefit from short-term market inefficiencies or market timing.

Can a Passive Investment Strategy Outperform Active Management and Improve Your Returns?

Markets can behave wildly and unpredictably in the short-term, but investment returns tend to behave much more predictably as the risk-return relationship plays out.

All investments have a specific risk and return profile that they eventually follow, which gives rise to the concept of reversion to the mean. It is very difficult to time this reversion, given how difficult it is to predict what could happen or how markets react to an event even if it were predicted and the timing was right.

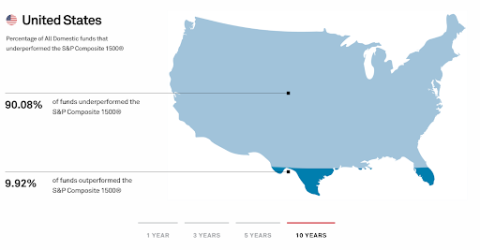

The S&P Dow Jones Indices publishes a robust, widely-referenced research piece known as The SPIVA Scorecard that compares actively managed funds against their appropriate benchmarks on a semi-annual basis.

SPIVA® research has shown over 15 years of published data surveying more than 10,000 actively managed funds globally that relatively few active managers can outperform passive managers over any given time period, let alone deliver above-average returns consistently over multiple time periods.

Referencing SPIVA’s ten-year data for the period ending June 30, 2024, you can see that almost 90% of funds failed to meet their benchmark return.

Benefits of Passive Investing

Not withstanding the proof shown in the chart above, there are plenty of reasons why professional investors from the late John Bogle to Warren Buffet praise the benefits of passive investing. Passive investing yields many tangible and intangible benefits to individual investors.

First, investors can often save more than 1.00% alone based on the average expense ratios of the funds being held in a portfolio. Based on the average expense ratios listed in the Investment Company Institute’s® 2020 Factbook, a 50% stock and 50% bond portfolio would carry an average expense ratio of 1.18%. Using only low-cost index funds, you can build an efficient, diversified portfolio for a weighted average expense ratio of less than 0.10%.

Second, passive investing strategies often require less trading activity. This means hat your retirement investment portfolio can benefit from lower transaction costs and higher tax efficiency.

Lastly, passive strategies are generally easier to understand than their more complex, actively managed counterparts. This relative simplicity and transparency make it easier to follow and evaluate the investment strategy, saving investors much stress and anxiety.

3 Steps to Smart Investment Portfolio Construction for Your Retirement Assets

The best investment strategy in retirement? A diversified portfolio with the right asset classes in the right proportions!

While it’s true that you can’t control the market, you can at least build an efficient portfolio that correctly exposes you to the right asset classes in the right proportions and that offers you broad, diversified market coverage without overlap.

Determine Your Asset Classes First

When building your retirement portfolio, we start by examining the investment universe for investable asset classes. For an asset class to be worth including in a portfolio, it should:

1). Be fundamentally different – For an asset class to be fundamentally different, it must be driven by unique risk that can be tested through a rolling correlation analysis so you can truly diversify your retirement portfolio.

The idea here is that it does no good to add an asset class to your investment portfolio that behaves like another asset class already in your portfolio.

We want asset classes that respond to different risks so that their movement is not correlated. This is the essence and benefit of diversification. If we have two assets, both with positive expected returns, but they both take a different path to those returns, it smooths the overall path of return the portfolio as a whole takes. In other words, it reduces the portfolio’s overall return volatility. This is a critical aspect of a diversified retirement portfolio.

2). Earn an expected real return – A real return is the portion of return that exceeds the rate of inflation. If an asset class cannot contribute to the real return over time, it makes no sense to add that asset class.

An example of an asset class that fails this part of the test is commodities. Commodities are not income-producing assets and therefore can not be valued as such and grow when income grows. The price of commodities is determined by supply and demand factors.

The price of a commodity will move up and down to maintain equilibrium between supply and demand. But over time, the equilibrium price will only move up by the rate of inflation.

3). Be investable in a low-cost, diversified way – Being able to invest in an asset class in a low-cost, diversified way means that a fund or product must exist that you can buy to give you broad-based exposure to the asset class at a low cost. Many asset classes fail this test.

Most alternative assets such as hedge funds and private equity fail the low-cost part of the test. Other asset classes such as collectibles and art fail this test because there is no way to invest in those assets in a diversified way. Read our take on using alternative asset investments in a retirement portfolio here.

As of this writing, the following nine asset classes pass these three tests, and we believe should be considered in an investment portfolio:

- U.S. Total Stock Market

- U.S. Real Estate Investment Trusts (REITs)

- Developed Markets Europe

- Developed Markets Asia-Pacific

- Emerging Markets

- U.S. Total Bond Market (investment grade)

- Total International Bond Market (investment grade)

- U.S. Treasury Inflation-Protected Securities

- U.S. High Yield Corporate Bonds (non-investment grade)

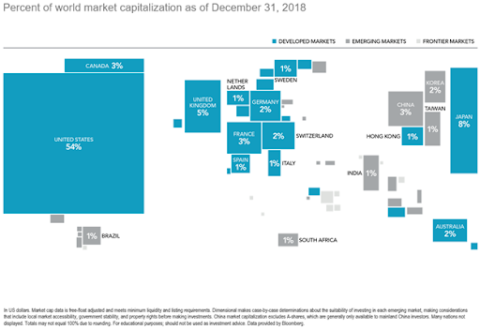

Now we must decide how much to allocate to each asset class. The modern portfolio-theory approach is to invest proportionally according to market capitalization. Otherwise, you are missing out on diversification and return potential as well as making a bet.

Examining the World’s Market Capitalizations

As an example, courtesy of Dimensional Fund Advisors, the following is the world’s stock market capitalization by country as of December 31, 2018:

This data suggests that an investor should maintain a 54% U.S. and 46% non-U.S. split in their stock allocation.

While this represents a reliable foundational approach as you put together your investment portfolio, there are several reasons for U.S.-based investors to maintain a slightly greater tilt to the U.S.

For example:

- Despite increasing efficiencies, global markets are not yet fully and seamlessly integrated, and transaction and investment costs generally remain proportionally higher in foreign markets than in the United States. Foreign markets also tend to have wider bid-ask spreads and higher management fees and friction costs.

- Some foreign markets do not have stable political and legal systems that are conducive to investment. Countries differ in their political risk exposures, regulatory frameworks, and pro-investor laws and protections.

- Investors have local and global biases (whether justified or not). Investors tend to prefer what is familiar to them, producing a behavioral bias toward local markets.

Maintaining some home country bias makes sense. We believe in a 60% U.S. and 40% international split on the portfolio’s stock side.

After following this approach with the remaining asset classes to determine your desired asset allocations, it is time to research the available fund universe to find the fund that best represents the asset class exposure you desire in your portfolio.

Determining the Best Funds to Complete Your Retirement Portfolio Allocation

So how do you go about choosing the best fund to optimize your retirement portfolio? The best fund will be the one that gives you the broadest possible exposure to the desired asset class that is also low-cost. As mentioned above, we believe that index funds are going to meet these criteria best.

An index fund is designed to capture the return of the "market" as defined by a benchmark index. For instance, an index fund designed to track the S&P 500 index will try to replicate that index’s return.

To find an index fund that will give us the broadest possible exposure to an asset class, we need to find an index with the broadest possible measure and then look at the available funds that track that index.

For example, numerous benchmark indices are designed to track the U.S. stock market. To name a few, there is the Dow Jones Industrial Average, the Standard and Poor’s (S&P) 500, and S&P Total U.S. Market Index.

While all are designed to track the U.S. stock market, they are created very differently and represent very different exposures within the Total U.S. Stock Market:

the Dow Jones Industrial Average only includes stocks of the largest 30 companies;

the S&P 500 only includes the stock of the largest 500 companies;

and the S&P Total U.S. Market Index includes approximately every stock available.

So clearly, the S&P Total U.S. Market Index would be the best available measure of the U.S. Total Stock Market asset class.

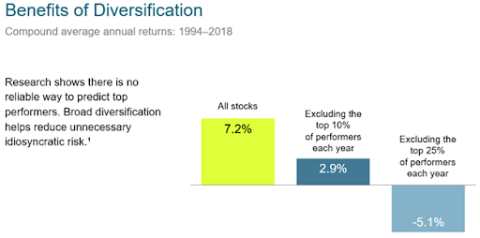

While this exercise may seem tedious, it is vital to your investment portfolio’s overall return potential. In any given year, the vast majority of the market’s return is driven by a relatively small proportion of stocks, and we have no way of knowing in advance which stocks will be those leaders.

Following is some research from Dimensional Fund Advisors:

An investor who simply held every stock available in the world across 44 countries from 1994 to 2018 would have received a 7.2% annualized return. Just removing the top 10% of performers each year would have taken that return down to 2.9%. If you were to remove the top 25% of performers each year, you would have actually lost -5.1% per year.

You cannot afford not to hold the potential winners, and you have no way of knowing in advance who they will be.

This is why we want the broadest exposure possible while avoiding overlap. The broader the exposure, the better your chance at capturing the market leaders in any given year.

Following this process for each asset class exposure you want to include in your investment portfolio can lead to some incredibly well-built and efficient portfolios.

This is a Portfolio Built for Retirement

Following the processes laid out in this insight, we at Thrive Retirement Specialists tailor portfolios for clients using nine index funds, each representing one of the nine asset classes identified earlier, as a starting point. We then will layer in existing low-cost basis holdings and other desired client holdings to arrive at an agreed upon custom portfolio that allows you to achieve your goals while being mindful of the tax consequences of any changes we make.

We help clients gain exposure to over 30,000 holdings across all investable 44 countries through these nine funds, all for a weighted average expense ratio of 0.07%, or less. Now, this is a portfolio built for retirement!

The best part? We do so while charging a flat fee rather than the norm of charging a percentage of asset under management (%AUM) fee, but this is another story (see our Insight entitled "Why a Flat-Fee Advisor is Best for Retirees" for more).

We stand by ready to help if you need assistance reassessing your investment portfolio. If you have any questions, please feel free to reach out.