3 Reasons Why Your Retirement Plan May Be Too Conservative

(READ TIME: ~6 MIN)

TAKEAWAYS:

- Overly conservative retirement income plans lead to unintended consequences like retirees sacrificing their quality of life and losing more wealth to Uncle Sam.

- Despite better alternatives, retirees and financial advisors still anchor to rules of thumb when developing retirement income plans.

- Being aware of just a handful of causes of overly conservative income plans can help you strike a balance between living your best life today without sacrificing tomorrow.

Many retirees and pre-retirees approach their retirement income planning with a conservative mindset, aiming to preserve their savings and ensure financial security in their later years. While this caution is understandable, overly conservative retirement portfolio withdrawal strategies can present their challenges.

Here, we discuss the main reasons why many retirees and their advisors err too much on the conservative side when it comes to retirement spending and the potential downsides of this approach.

How Withdrawals Rates Affect Retirement Income Plans

As retirement planning specialists, we like to keep an eye on the latest research to ensure we’re always providing clients with data-backed recommendations. Morningstar is starting to up its game when it comes to its annual safe withdrawal rates research. The Good News on Safe Withdrawal Rates expands the variety of income withdrawal strategies tested, including flexible “guardrails,” similar to the dynamic approach that benefits our clients.

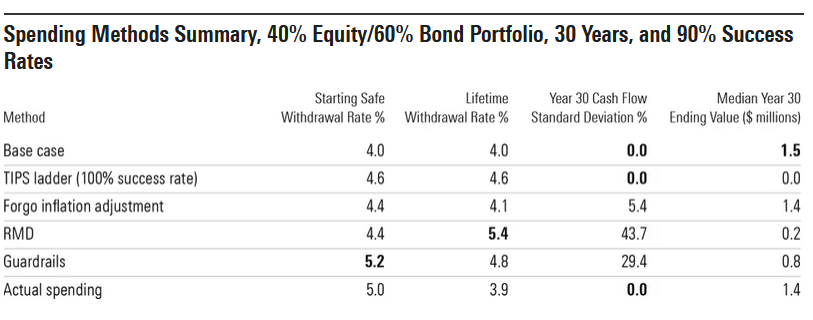

Despite the media headlines latching on to the co-author’s proclamation that the 4% rule may finally hold true, the inclusion of a guardrails strategy (and its 5.2% safe withdrawal rate!) exposes how rules of thumb produce overly conservative retirement income plans and arms retirees with alternatives to the status quo.

In the spirit of helping retirees avoid unnecessary spending sacrifices, let’s look at a few factors that commonly contribute to overly conservative retirement income plans.

1. Relying on Rules of Thumb

We don’t have anything against rules of thumb, per se. If you are at a cocktail party engaged in a spirited discussion on how much you can sustainably spend throughout retirement, the 4% rule is useful. However, think again if you are about to provide your employer with a retirement date. You deserve better than what the Oxford Dictionary defines as “a broadly accurate guide…”.

Rules of thumb require simplified assumptions, which is fine for the masses but inadequate for the individual. In the case of the 4% Rule, the original research done in 1994 by William Bengen assumed (1) a 50% stock and 50% bond asset allocation, (2) using only the S&P 500 to represent stocks and intermediate-term U.S. government bonds to represent bonds, and (3) a fixed, inflation-adjusted annual withdrawal for 30 years that didn’t consider any changes to withdrawals based on how investments performed.

Although Morningstar has improved upon the original assumptions used to arrive at the 4% rule for their "Base Case," their latest research suggests that by taking a flexible approach based on portfolio performance – withdrawing less in bad markets and more in good ones -- retirees can meaningfully increase their starting and lifetime withdrawals to 5.2% and 4.8%, respectively! Below are the results of their study.

Despite attractive alternatives, many retirees and financial advisors still anchor to rules of thumb -- like the 4% rule -- because they are ubiquitous and easy to understand.

Sadly, this can result in a retirement income plan that deprives retirees of having a potentially higher quality of life and leaves more significant account balances upon death than desired.

2. Misinterpreting Monte Carlo Simulation Results

Named after the Monte Carlo Casino in Monaco, most financial planning software uses this simulation method to determine the probability of success for a given retirement income plan. It runs numerous simulations, each with its own set of randomized investment returns, to produce a spectrum of possible outcomes that mimic good, bad, and middle-of-the-road investment returns for the length of a retiree's income plan. This can be helpful when you’re building or adjusting an optimal investment portfolio for retirement as it can help you determine whether you should get more conservative or aggressive with your portfolio assets.

Once the simulation is complete, the results are tabulated to show – often as a “success” rate -- the likelihood of the investment portfolio sustaining the planned withdrawals. For example, if 1,000 simulations were run (common for financial planning software), of which 800 supported the retiree’s planned spending, the result would be an 80% probability of success.

The Downsides of Monte Carlo simulation in Retirement Income Planning

While Monte Carlo is a valuable tool, that we as retirement planning specialists use as well, it has shortfalls. The main one is driven by the fact that investment markets are not purely random. If the S&P 500 declined by 34%, like in 2020, as a reaction to the COVID-19 pandemic, there is not an equal chance of the market suffering a 56% decline in the immediately following years as what was experienced during the Financial Crisis. But this extreme scenario can be one of Monte Carlo’s simulated observations.

Markets tend to go up more than they go down, and down periods are typically followed by a period of positive performance and vice-versa.

So, the wildly positive and wildly negative simulations that Monte Carlo produces are highly unlikely to occur. Our focus is on downside scenarios when planning for retirement, so it is essential to consider how Monte Carlo may overestimate the downside possibilities for your retirement income plan.

Something else to consider when taking Monte Carlo simulation results into account is your targeted success rate. Many retirees plan for a 90% probability of success (i.e., 90th percentile success rate) because they interpret it as meaning they have a 10% chance of failing in retirement, which is the highest risk they’re willing to take. And quite frankly, I don’t blame them!

The good news is that’s not the case. To look at it another way, a 90% probability of success means there is a 10% probability that an adjustment will need to be made during your retirement to avoid running out of money. Yes -- adjust, not fail. Often, these adjustments are minor and infrequent but can significantly improve safe withdrawal rates, as seen in this year’s Morningstar study. If you can be a little flexible (which is intuitive during our working years), planning for a 90% success rate may be overly conservative.

3. No Retirement Spending Plan

Many retirees think their spending will increase during retirement. After all, they will have time to take the European vacation they have always wanted, and let’s not forget about rising healthcare costs.

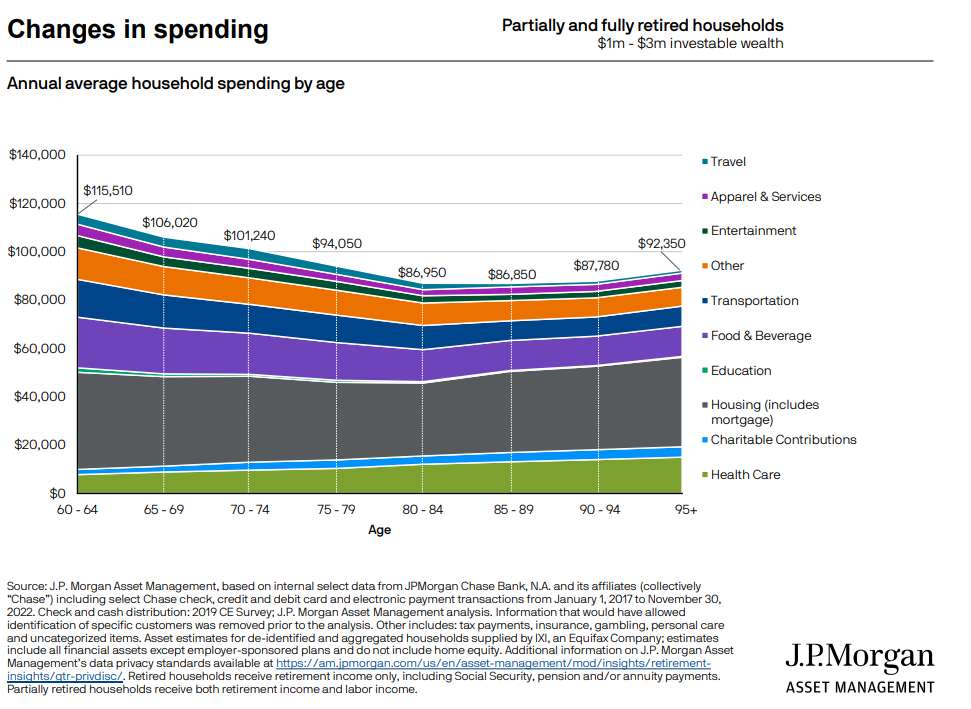

Although counterintuitive, research suggests the opposite: spending (when adjusted for inflation) actually decreases as we age. The result? Overestimating the cost of retirement.

In the 2014 paper “Exploring the Retirement Consumption Puzzle,” David Blanchett observed that average spending in retirement decreases by approximately 1% annually. But that doesn’t mean retirees aren’t enjoying an espresso in Rome or not requiring assistance with their daily activities. Indeed, spending tends to spike in both early and late retirement, as is expected, but spending tends to be lower in between.

This has been aptly dubbed the “Retirement Smile,” as shown below.

Creating a retirement spending plan that considers how expenses may evolve can dramatically improve a retirement income plan. In other words, by simply recognizing that you will not be scuba diving in the Galapagos Islands at age 85 and trimming your planned travel expenses accordingly, you may be able to retire earlier or take an extra vacation now.

Our clients often find it helpful to start creating their retirement spending plan by reviewing their credit card spending summary, which already provides a good baseline. From there, organizing expenses into categories such as "essential" and "discretionary," along with other planned expenditures like travel, covers most of the groundwork. By investing a little time to plan with intention, you can avoid making unnecessary sacrifices in retirement.

If you need help reviewing your portfolio to make sure you're positioned well for retirement, we are here to help. You can click here to schedule an informal, introductory Zoom call with one of our retirement planning specialists to get started.