Can You "Self-Fund" Long-Term Care?

(READ TIME: ~6 MIN)

TAKEAWAYS:

-

56% of Americans turning age 65 today will need long-term care, with an average duration of 3.6 years for women and 2.5 years for men.

-

The annual median cost of a private nursing home room is $116,800, which could wreak havoc on your retirement income without a plan.

-

Despite the risk, less than 8% of Americans have long-term care insurance policies, partly due to high premiums and insurers exiting the market.

Long-term care costs represent one of the most significant spending shocks a retiree can encounter. Self-funding these potential costs with assets (versus insurance) is the most straightforward method of addressing this risk and the first option we explore when developing long-term care strategies for our clients. No retirement income plan is complete without a strategy to manage long-term care costs, so let’s look at how you can assess your risk and ability to self-fund.

What is Long-Term Care?

Long-term care is a category of needs separate from general health care. Generally, it can be defined as needing help with two or more activities of daily living (or ADLs), such as bathing, toileting, dressing, walking, and eating. Severe cognitive impairment, like dementia, is also a long-term care need. This means that long-term care needs arise from both physical and mental impairment.

Assessing the Risk to Retirees

Prevalence and Duration

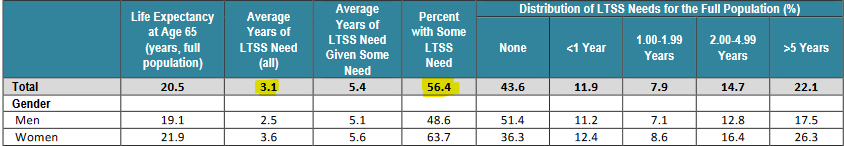

In their August 2022 research brief, the Department of Health and Human Services estimates that more than half (56%) of Americans turning 65 today will need long-term care for an average duration of about 3 years. Not surprisingly, women are not only more likely to need care than men (64% vs. 49%) but also for a longer time (3.6 vs. 2.5 years).

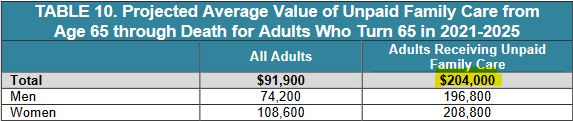

Although these estimates are scary, there is an important nuance: the figures in the above table include both paid (e.g., nursing home) and unpaid (e.g., help from family) care. Unpaid care provided by family and friends makes up a substantial portion of care, so much so that estimates suggest the average value reaches $204k!

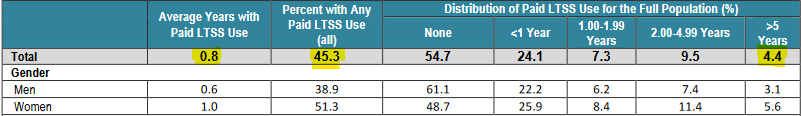

So, how much paid care should you expect? On average, 45% of adults aged 65 will need paid care lasting about 1 year, and only 4% will require care longer than 5 years.

Long-Term Care Costs

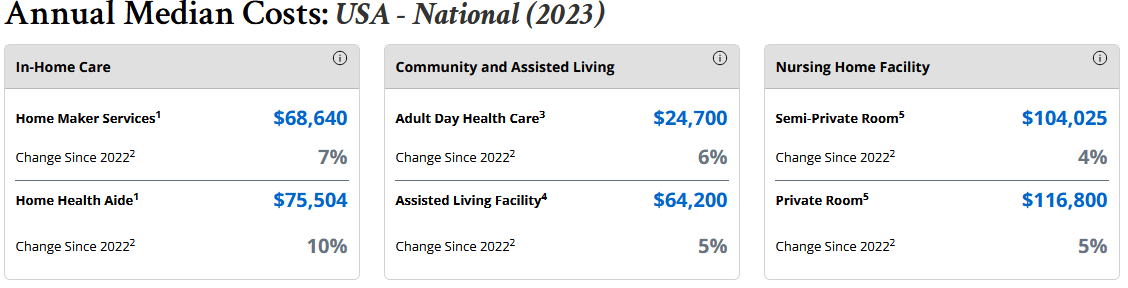

Median costs for long-term care can vary dramatically depending on the type of care and geographic location. Genworth’s Cost of Care Survey shows that annual costs range nationally from $68,640 for in-home care to $116,800 for a private nursing home room. We recommend using Genworth’s website to get estimates for your location instead of relying on the national median.

Inflation is another consideration. As the above Cost of Care Survey shows, long-term care costs have been inflating at a higher rate than overall inflation. This trend will likely continue if the demand for these services grows along with our aging population. For retirement planning purposes, assuming a 5% inflation rate is reasonable.

Can You Self-Fund?

There is no one-size-fits-all strategy for managing potential long-term care costs. Instead, it’s vital to consider your unique situation and preferences and the research to arrive at reasonable assumptions for your retirement income plan and determine if self-funding is viable.

Here are three steps to test the viability of your self-funding strategy:

- Determine the type of long-term care scenario you want to prepare for based on your health, family history, and preferences. At what age might your long-term care need occur, for how long, and at what cost?

Consider the following:

- If you are in excellent health or longevity or dementia runs in your family, it’s best to plan for more years of paid care than average. But remember, only 4% of the population needs paid care for longer than 5 years.

- Plan for more years of paid care if you are single/living alone or don’t live near family, as you are less likely to receive unpaid care.

- Use Genworth’s Cost of Care Survey to get the median cost in your area for the type of care you wish to receive.

- Review your retirement spending plan (you have a spending plan, right?) to identify expenses that would decrease or be eliminated should you need long-term. Keep in mind that long-term care costs offset other costs. For example, if you move into a nursing home, property taxes and insurance would be eliminated if you sold your home, and your grocery bill would drop significantly. Create a separate spending plan that includes these cost offsets.

- Create a scenario in the retirement income planning tool of your choice using the assumptions from steps #1 and #2 to test your ability to self-fund, ideally using Monte Carlo simulation.

Here’s a simple scenario for a single woman in excellent health, age 65, who lives near family:

- Age 95 is when her paid long-term care needs start.

- 3 years of paid long-term care will be needed (age 97 planning timeline).

- $116,000 of annual long-term care costs for a private nursing home room inflated at 5%.

- $60,000 reduction to her annual spending plan at age 95 ($100,000 before her long-term care need, a 60% reduction).

Explore All Options

What are your results? If the Monte Carlo simulation is favorable, great! But if it’s not, you must take some additional steps.

First, ensure that you include all assets as funding sources, especially your home equity (i.e., likely the largest asset on your balance sheet). Assuming a reverse mortgage or home sale can go a long way. If that doesn’t help, tradeoffs may be needed. Consider choosing a different type of care, like a semi-private instead of a private nursing home room, or reducing some of your discretionary spending today to preserve assets available as a funding source. And let’s not forget that looking into long-term care insurance is an option.

Often overlooked (or avoided), a potential long-term care need is too big of a risk to ignore. If you want to develop a strategy that manages the risk of substantial long-term care costs without making unnecessary sacrifices today, we are here to help. You can click here to schedule an informal, introductory Zoom call to get started.