Is Your Rollover IRA a Ticking Tax Time Bomb?

Many clients join us when they reach Required Minimum Distribution age and find out that they have a tax problem.

Suddenly, they realize they will be forced to take out more money than they need from their IRAs and that the withdrawals will be taxed at higher ordinary income tax rates. To make things worse, they realize their RMDs will likely continue to grow year over year as their growing IRA balance meets a shortening life expectancy.

So what exactly is a Required Minimum Distribution and how can it affect your tax bill in retirement when you have IRAs and other retirement accounts? Read on to learn about the three potential tax pitfalls in retirement and how to navigate them.

1) Required Minimum Distributions

A Required Minimum Distribution (RMD) is the minimum amount you must withdraw each year from your retirement accounts once you reach age 73 (if born between 1951 and 1959) or 75 (if born in 1960 or later) (as of 2025). This applies to traditional IRAs, SEP IRAs, SIMPLE IRAs, and employer-sponsored retirement plans. RMDs are required because these accounts have tax-deferred growth, and the IRS wants to ensure they are eventually taxed.

RMD calculations are fairly simple: You take the account balance at the end of the previous year and divide it by a life expectancy factor provided by the IRS. If your retirement account balance is steadily growing, you need to take out more money as your life expectancy decreases, meaning you will need to pay more taxes on the larger amount taken out.

2) Income-Related Monthly Adjustment Amount (IRMAA)

As if the additional income from the RMD was not enough of a pain (for your tax bill at least), many new retirees are also surprised to learn that this new significant increase in income will also push them into (often high) Income-Related Monthly Adjustment Amount (IRMAA) premium brackets that can increase their monthly Medicare charges by up to $629/mo per person (that is an additional $15,096 annually for a couple).

3) Widow’s Penalty

Another often-overlooked tax challenge in retirement is the widow’s penalty, which can significantly increase a surviving spouse’s tax burden after the death of their partner.

If one spouse is older or in poor health, there is a greater chance of leaving the other spouse with all of this income that would have to be applied to a single-filer tax schedule, substantially increasing the effective rate of taxation on the same income (less the couple’s lowest Social Security benefit, which would cease).

How Did We Get Here?

As retirement planning specialists, the common theme that we see with all of these clients is that they retired with large pre-tax IRA balances and then simply followed a “conventional wisdom” withdrawal strategy. Conventional wisdom is a widely followed strategy (with a horribly misleading name) that recommends you withdraw first from your after-tax brokerage account savings, then pre-tax IRA savings, and then from tax-free Roth IRA savings.

Let’s pretend we have a couple retiring at age 60 with $2M in IRA balances and $3M in after-tax brokerage accounts. Life is great in the beginning. Retirement living expenses are being funded from after-tax brokerage savings, and the only tax is a little capital gains tax, depending on the amount of gain embedded in your after-tax brokerage investments. There is no more wage income, and Social Security won’t start for 10 years, so there is no ordinary income to tax.

After paying five and six-digit tax bills every year while working, you feel like you’re getting away with something paying so little in tax...

A Tax Problem is Brewing

What is actually happening, though, are two things:

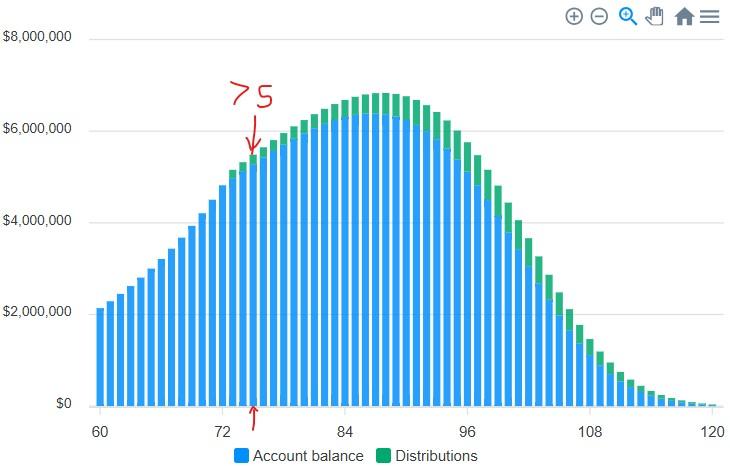

First, your $2M in pre-tax IRA balance is growing during this time of seeming tax bliss. Following is an example of a $2M IRA balance growing at a 7% annual return (the average long-term real (i.e., excluding inflation) return on a 60% stock and 40% bond portfolio is 6.8% -- so this is like looking at possibilities in today’s dollars):

This couple’s Required Minimum Distribution (RMD) age is a long way off at 75, but their IRA balance continues to grow, reaching $5.2M by their RMD age in this example. Dividing this balance by the IRS’s life expectancy factor leaves them with a $210k RMD at 75. Add this to their Social Security, and they’re over $300k in income, all taxed at higher ordinary income tax rates.

Welcome back to the world of five and six-digit tax bills.

What’s worse is that their RMDs continue to increase steadily year after year. By age 85, when they’ll likely be spending less as they enter the “slow-go” stage of retirement, their RMD would be $400k. At 85, they could be paying ordinary income tax on almost $500k of income with Social Security that they don’t even need. Even at today’s generous tax code brackets, they would be in the 35% Federal marginal tax bracket. Their RMDs will continue to climb until they pass, reaching $650k by age 100.

...Plus Additional Taxes for Your Heirs

When you pass, your remaining IRA balance will pass to your beneficiaries as an inherited IRA, where they will be required to make RMDs and exhaust the IRA’s balance in ten years. For many, this means passing this IRA to their children, who are very likely in their peak earnings years.

While the children will undoubtedly be appreciative, so much of the IRA balance will get eaten up by taxes as the RMD income is placed upon their work income and taxed at their highest marginal tax rates.

The second thing that is happening is that you are wasting the opportunity to take full advantage of your standard deduction ($30k in 2025) and filling today’s lower marginal income tax brackets:

It takes ordinary income (not capital gain income) to use up your $30k standard deduction and fill the lower income tax brackets. $127k of ordinary income would allow you to use your $30k standard deduction and fill the $23,850 10% bracket and the $73,100 12% bracket. When will you ever get the chance to pay such a low effective Federal tax rate of 8.8% on $127k of income again? Certainly not when Social Security and RMDs start.

The Solution? A Roth IRA Conversion Strategy

A carefully crafted Roth IRA conversion strategy is the perfect tool for the job. So what is a Roth IRA conversion and how could it help you avoid or reduce unpleasant tax surprises in retirement?

When you execute a Roth IRA conversion, you are taking money from your pre-tax IRA account and moving it to a Roth IRA account, where the proceeds and all the future growth of those proceeds will never be taxed again. This action does two important things.

First, it allows us to recognize ordinary income today so you can take advantage of your standard deduction and take advantage of your lower federal marginal tax rates. You will receive a 1099 for the amount of Roth IRA conversion, which will be taxable as ordinary income in the year taken.

Second, you are directly reducing the size of your IRA balance and removing the future growth that would have been associated with that portion of the balance that has been transferred. This allows you to strategically reduce the size of your IRA balance over the years before RMD age hits so you can reduce your future RMDs to a level that makes more sense for your situation.

At the end of the day, a Roth IRA conversion strategy will increase your taxes in the years while you are executing the Roth IRA conversions, but it will lead to significantly lower tax bills later and have the overall effect of materially lowering your average lifetime tax bill.

As an added benefit, your beneficiaries will be much happier receiving a beneficiary Roth IRA. While your beneficiaries will still have to exhaust the account within ten years, none of the income is taxable when it is taken, allowing the entire balance to flow to your beneficiaries instead of the IRS taking a big bite first.

To find out whether a Roth IRA conversion could help you achieve your retirement goals (and how to execute the strategy if so), schedule your complimentary call with one of our retirement planning specialists today.