Money Market VS Bonds: Which One Should You Use in Your Portfolio?

As of April 2025, money market funds are sporting yields of over 4.0% (Schwab’s SWVXX was yielding 4.17%) while the U.S. Aggregate Bond Index has only returned a minuscule 2.18% cumulative return over the past three years.

As a result, we are often asked: “Why not just hold the money market instead of bonds?”. After all, money market funds present less risk than bonds because they do not fluctuate in value in response to changes in interest rates. This is because money markets typically invest in short-term maturity investments less than 30 days. This is one of those situations where things may seem correct in hindsight.

As retirement planning specialists, we currently believe that investors should favor investing in bonds rather than a money market fund for all but meeting near-term income needs. Here are 3 reasons why.

1). Bonds Typically Offer a Higher Yield and Greater Return Potential

Investors require a greater yield to take on the additional risks. That’s why the Bloomberg U.S. Aggregate Bond Index will almost always offer a higher yield and return than money market funds. The index invests in bonds with a longer average maturity (of 7.7 years) and bonds with higher credit risk (though still considered investment grade).

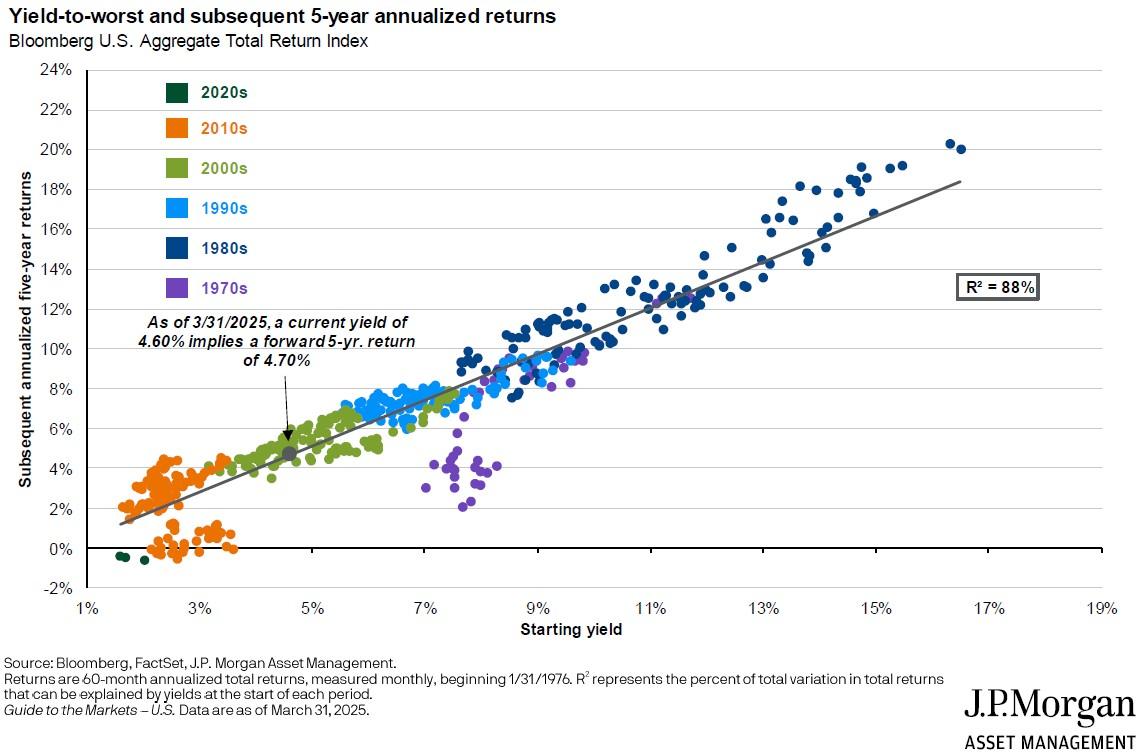

The best indicator of expected return for the Bloomberg U.S. Aggregate Bond Index is its current yield. As of this writing, the Bloomberg Aggregate Bond Index offered a current yield of 4.62%.

As of the end of March 31st, 2025, the current yield of 4.60% implied a forward five-year annualized return expectation of 4.70%. A potential annualized return of 4.70% over the next five years will look even more appealing as money market yields drop in lock-step with future expected Federal Reserve rate cuts (which have already been priced into the Bloomberg U.S. Aggregate Bond Index).

But What About Those Bond Losses in 2022?

Those who have held bonds in the recent years may have experienced quite a bit more turbulence than usual, potentially leading them to consider shifting out of bonds.

But like any investments, bonds are not immune from investment risk, and unfortunately, we investors tend to suffer from a behavioral economics phenomenon known as recency bias. This is the tendency for people to overweigh recent events without considering the objective probabilities of those events recurring over the long run.

When the level of interest rates increase (or market expectations for interest rates increase), the value of bonds declines. To learn more about this important feature of bonds, click here to read our insight Bonds 101: What They Are and Their Importance in a Diversified Investment Portfolio.

What happened to bonds in 2022 was akin in relative severity to what happened to stocks during the dot com bust of 2000-2001 or the Great Recession of 2008-2009.

You may recall that the Federal Reserve had driven interest rates down to near-zero (i.e., the bubble) to try to dampen the effects of the Great Recession of 2008-2009. Rates had remained there until a rapid bout of inflation was fueled by surging post-COVID demand trying to be met by a COVID-constrained supply chain.

To fight this inflation, the Federal Reserve had to raise rates faster (i.e., the bursting) than at any point in history. This is what then led to the steep declines in bond prices.

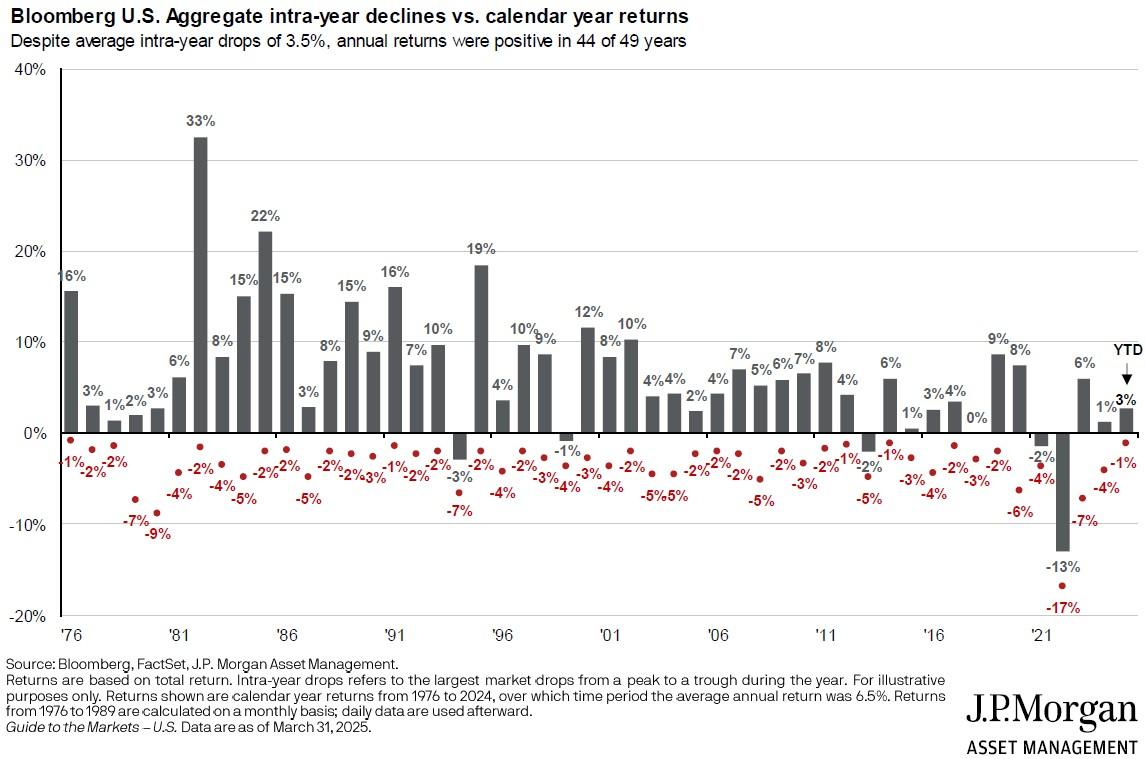

You can see from the chart below that the negative -13% return from the Bloomberg U.S. Aggregate Bond Index in 2022 was by far the worst year experienced since at least 1976. Only four other years of negative returns (between -1% and -3%) were experienced during the entire 49-year period.

What happened to bonds in 2022 was the culmination of many unique events that led to one of the worst bond market losses in history. As bad as a negative -13% return was for bonds, it still pales in comparison to what can happen to stocks:

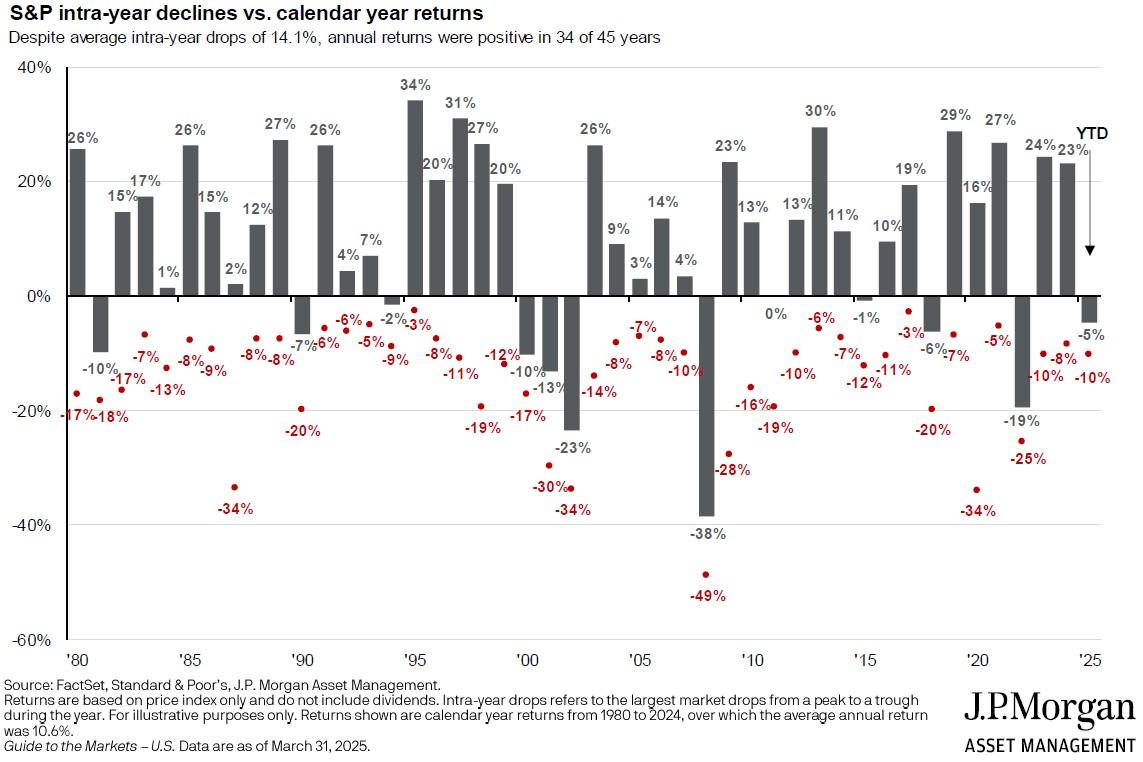

The S&P 500 was down a cumulative 46% during the dot com bust. During the Great Recession, the S&P 500 lost 38% by the end of 2008 and more in 2009 before the market started to recover. These were severe stock market drops similar in relative severity to what bonds went through in 2022.

2). Bonds Lower a Balanced Portfolio’s Risk

Aside from offering a greater return potential than money market funds, bonds also provide a balanced portfolio with a source of diversification that lowers the overall portfolio’s level of risk (or volatility). During adverse economic and market conditions, bonds tend to exhibit a negative correlation with stocks, meaning they move in opposite directions, lessening the impact a sudden drop in stocks can have on your overall portfolio’s performance.

As stocks drop in value and bonds rise in value, the asset allocation in a portfolio becomes skewed towards bonds. Following a disciplined rebalancing policy would require selling bonds that went up in value to buy stocks that went down in value (what a great time to have to buy more stock, right?), so the portfolio remains well positioned to ride the eventual recovery.

3). Anomalies Don’t Change Long-Term History

Again, to address our recency bias, bond values did not increase when stock values decreased in 2022. The normal cycle of the economy is expansion, peak, contraction, and recovery. Most contractions occur when an economic shock is caused by a sudden change to an external supply and/or demand factor.

As the threat of recession (or contraction) plays out, the odds of the Federal Reserve lowering interest rates to soften the blow by trying to encourage greater demand increase. As rates (and rate expectations) decrease, bond prices increase. Aside from fear motivating one to seek the relative safety of bonds during an economic downturn, this is generally what causes bond prices to rise when stock values are dropping.

Remember, 2022 was a unique animal. Here’s why: First, before 2022, interest rates were already near zero from the Great Recession, so they could not go any lower (i.e., the bubble), and bond prices could not really go up. Second, surging post-COVID demand not being able to be met by a post-COVID constrained supply chain caused prices to skyrocket (i.e., inflation).

How does the Federal Reserve fight inflation? By increasing interest rates to slow down demand. What happens to bond values when interest rates go up? They decline. At this same time, the fear of rapidly increasing interest rates slowing the economy down too much and sending us into a recession caused investors to sell off stocks.

The Case for Money Markets as Part of Your Portfolio

With inflation having moderated and appearing to be back under control and interest rates being once again at healthy market levels, what happened to bonds in 2022 should hopefully not recur.

Investors have to keep their eye on the future and not the past. Money market funds have a role in meeting near-term expenses, but they are not a good substitute for bonds in a balanced portfolio.

If you’d like to discuss how to best manage your cash holdings and investments in the current market, get in touch with one of our retirement planning specialists and get your Complimentary Thrive Assessment here.