Retirement Planning in the Face of Low Expected Returns

(~READ TIME: 7 MIN)

TAKEAWAYS:

- Working longer or spending less in retirement are not the only ways to improve your retirement plan.

- Five solutions exist that can materially improve your retirement plan.

- Your retirement is impacted more by the sequence of annual returns you experience than by the average return you experience during retirement.

Expected market returns play a key role in a retirement plan. What can one do to improve their situation in light of lower expected returns besides the conventional advice of working longer or spending less in retirement? Fortunately, there are at least five other solutions we can consider to make material differences in one’s retirement planning without resorting to working longer or spending less.

1). Lower Your Total Cost of Investment Management

All investors have investment costs. Investors can see the fee paid to their financial advisor, but often they are unaware of the fee taken by each mutual fund or exchange-traded fund (ETF) they hold (determined by each fund's expense ratio). Morningstar’s latest annual expense ratio study found the average asset-weighted fee paid by investors in active funds stood at 0.60% in 2021. I have personally analyzed many portfolios, and it is not uncommon to find weighted average expense ratios of 1.5% or more. Suppose a couple has a $2.5 million investment portfolio being managed by a typical 1.0% advisor who invests in active funds costing the 0.60% average. In that case, this couple is paying a whopping 1.60% of their portfolio, or $40,000, per year in fees.

Contrast this to finding a flat-fee advisor, such as Thrive Retirement Specialists charging $9,000 annually, who invests in a portfolio of low-cost index funds carrying a weighted average expense ratio of only 0.07%. This couple with a $2,500,000 portfolio now only pays $10,750 per year. This $29,250 savings per year is like earning an extra 1.17% annual return. (See our Insight entitled "Building an Investment Portfolio for Retirement" for more)

2). Maximize Social Security Claiming Decision

Social Security will likely be your only source of inflation-adjusted reliable income in retirement. Reliable income is steady income that does not fluctuate with markets. Further, this income will be paid to you until you pass, so you cannot outspend it. This all combines to make your Social Security claiming strategy of significant importance to your retirement plan.

3). Improve Your Situation Through Strategic Tax Management

In retirement, there are many things we do not have control over, so we must take advantage of those things we do have some control over. We cannot control tax policy, but we can take advantage of our situation within that policy. Being strategic about how you withdraw money from which account type (i.e., taxable, pre-tax, and Roth) and when can materially reduce your lifetime tax liability. An IRA Roth conversion strategy is often a part of this math. Vanguard’s Advisor’s Alpha research concludes that withdrawal order sequencing alone can add up to 1.10% of annual return-equivalent value per year. (See our Insight entitled "Developing a Retirement Income Strategy to Minimize Lifetime Taxes" for more)

There are also opportunities to be tax efficient when it comes to asset management. Taking advantage of asset location, tax loss harvesting, gain harvesting, and asset selection can all add incremental value. Vanguard’s Advisor’s Alpha research found that up to 0.75% of annual return-equivalent value can be added through these strategies.

4). Improve Your Situation Through Active Sequence of Returns Risk Management

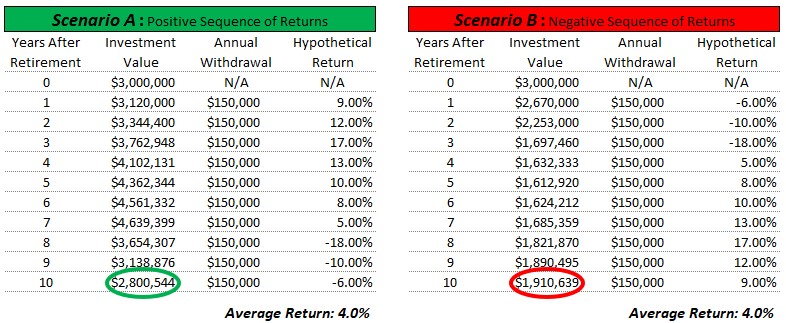

The longer you study retirement planning, the clearer it becomes that a retiree’s outcome has far less to do with the average return they experience over their retired lives and far more to do with the actual sequence of annual returns they experience. This can be seen in the example below, where two retirees both start with $3,000,000 but end up with very different remaining amounts after just ten years, given the exact same average return of 4.0% over the time period:

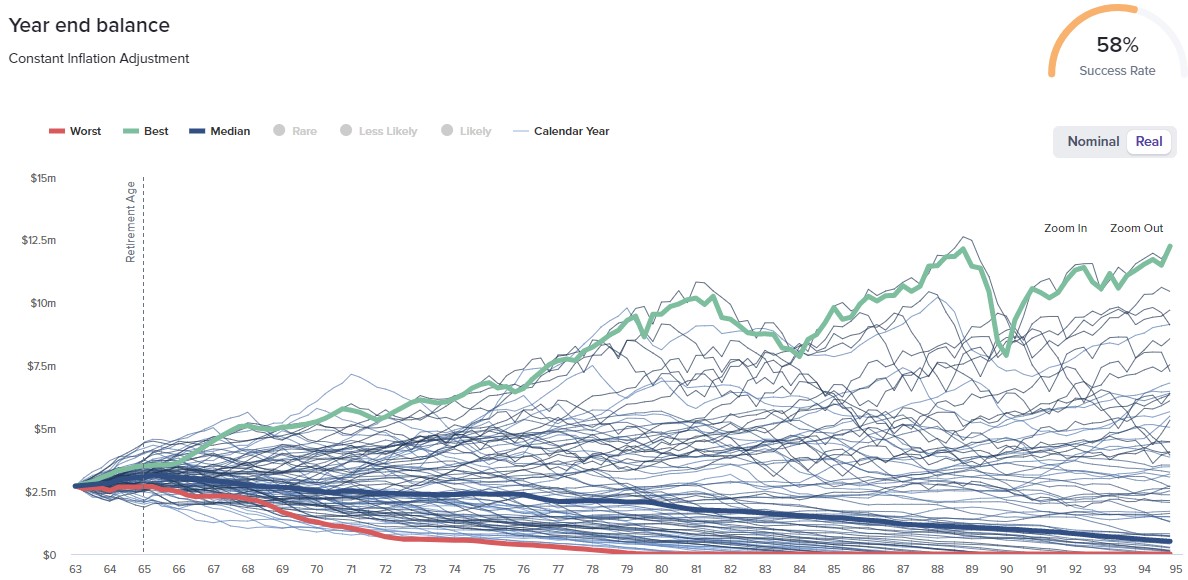

The following historical simulation analysis of a sample retirement plan provides another stark example:

Historical simulation analysis takes a retiree's plan and drops it back in time to see how it would have performed historically. Each of these lines represent how the plan would perform under each actual sequence of returns paths experienced historically. For example, the worst-case sequence of returns for this retiree with this plan would have been experienced if this retiree would have retired in May of 1911. Unfortunately, based on this historical sequence of returns, without making any adjustments, the retiree would run out of money at 79 years old (16 years short of his single life expectancy). If this retiree had the good fortune to experience a sequence of returns like someone who retired with this plan in February of 1982 (the green line), the retiree would still have $12.3 million left at the end of their 95-year life expectancy (again, assuming no adjustments).

This wide range of possible outcomes highlights how critical your experienced sequence of returns path is to your retirement outcome. Every one of these outcomes is based on the exact same 60% stock and 40% bond portfolio. While the average return experienced from this portfolio clearly has some impact, it is the sequence of those returns that create the enormous difference in possible outcomes.

We have tools and strategies available to us to manage this negative sequence of returns risk. Since a retiree’s retirement plan is often governed by the bottom 10% of modeled outcomes, some simple strategies that can be employed to partially mitigate some of these worst-case outcomes can do wonders for a retiree’s plan.

5). Improve Your Situation Through Adopting Dynamic Withdrawal Rules

One of the most powerful tools in our retirement planning tool chest is the application of dynamic withdrawal rules. Dynamic withdrawal rules present us with a superior, reality-based alternative to the old linear way of thinking presented by determining a sustainable withdrawal rate. The “4% rule” was born from this meaningless way of thinking. Is a retiree’s goal to be so conservative in their planning that they find the maximum level of steady spending they could take without the need for ever making an adjustment over a 30- to 40-year period and still be alright under the single worst-case possible historical sequence of returns scenario?

This is ludicrous! First, imagine the amount of money (or potential higher quality of life in retirement while living) you would leave on the table in all but the single worst-case scenario. Looking at the historical simulation analysis presented previously, the spending under this plan would have to be adjusted downward substantially to get to a “4% rule-like” sustainable withdrawal rate. Doing so would only make the better case outcomes even higher than passing away with $12.3 million. Second, we can and should make adjustments during a 30- to 40-year retirement based on the reality of what is happening. If a retiree experiences anything better than a bottom 10% of sequence of return scenarios while going through their own retirement (which has a 90% probability of being true), doesn’t it make sense that spending should be able to increase since there would be more resources left and a shorter time-horizon?

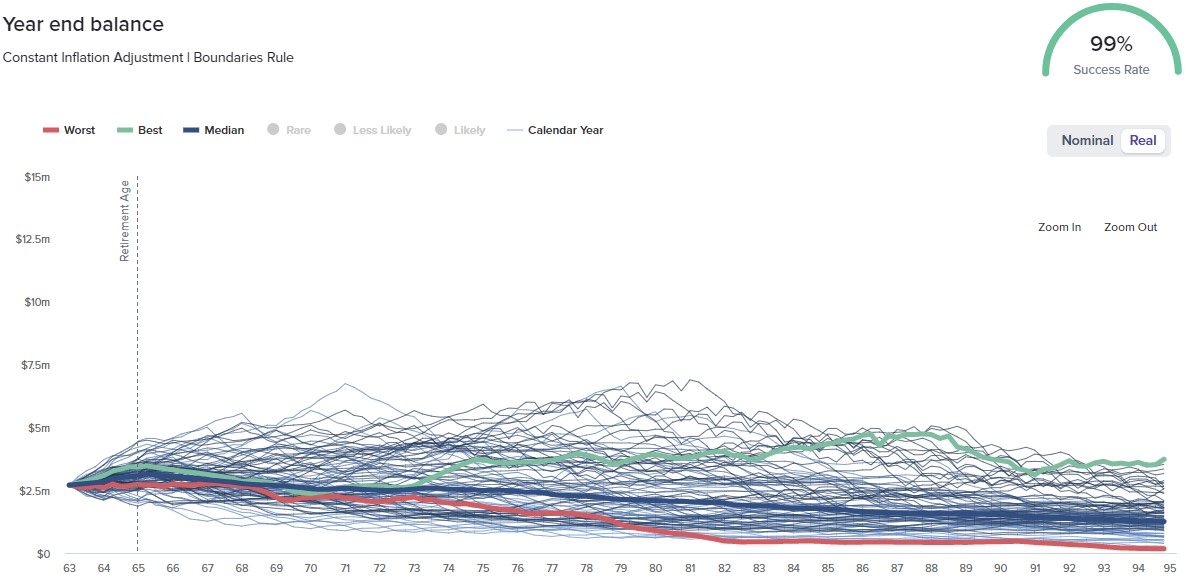

This is precisely the role of dynamic withdrawal rules. Dynamic withdrawal rules are a set of rules that we review annually to see if we can make adjustments to spending based on what has actually happened. If we chose to place a set of dynamic withdrawal rules over the retiree’s plan from our previous example rather than working longer or reducing spending, we get the following:

Notice that without reducing spending or working longer, we can get to a 99% success rate from the previous 58%. Also, notice how the range of possible outcomes narrows substantially. This is because we are making periodic adjustments as we proceed. Under the worst-case scenarios, this means making reductions to spending at times. Under all but the worst-case scenarios, it means increasing spending at times. What is not visible here is the amount of money the retiree can spend under each of these outcomes. For example, the best case outcome is now passing with $3.7 million rather than the $12.3 million in the non-dynamic withdrawal rules scenario. This is because the retiree increased the amount they could spend while living in retirement and was able to take cumulative withdrawals of $8.9 million instead of only $4.6 million under the non-dynamic withdrawal rule scenario (a 93% increase in spending during retirement while taking less risk). (See our Insight entitled "Quantifying the Value of Dynamic Withdrawal Rules" for more)

We Can’t Control Market Returns

We cannot control market returns nor can we know in advance the sequence of returns that you will experience in the future. The good news is there are other potential solutions to improving a retirement plan besides simply working longer or spending less in retirement.

If you would like to better understand how the solutions discussed above can help you, we stand by ready to help. To learn more, you can schedule a friendly, informal call for a date and time that is convenient for you here at this link: https://calendly.com/thriveretire/thriveretire-call or contact us here at any time.