New clients came to me recently feeling very proud they could craft a retirement spending plan budget (see our Insight entitled "How to Create a Retirement

No matter your generation, retirement is a reality we all will face, whether voluntary or forced. Following are retirement strategy tips to consider at every

Read More

We have written on the tremendous value dynamic withdrawal rules can bring to a retirement plan through the strategy’s ability to manage sequence of returns

Read More

Last week, Morningstar published some new research entitled “The State of Retirement Income: Safe Withdrawal Rates” that claims the old “4% rule” should be

Read More

While estate planning is certainly not the most joyful part of the retirement planning process, planning for what might happen if you have an unexpected health

Read More

This one financial product generates many questions...and some controversy. Annuities - are they good or bad?

Read More

Before we get into creating a Retirement Spending Plan and share a link to the spreadsheet we use for this exercise, let’s first explore what a Retirement

Read More

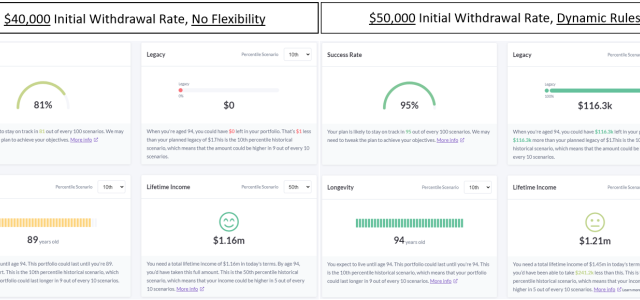

The Value of Dynamic Withdrawal Rules

We have written in the past about the value of tax management strategies and mentioned that Vanguard, in their Advisor’s

Retirement planning is still a relatively new discipline within the wealth management industry. Especially when it comes to asset decumulation, or the funding

Read More

Discover why a flat fee financial advisor is the best choice for retirees. Learn about the advantages of flat fee financial advice, including cost-effectiveness

Read More

Suppose you could allow yourself a little flexibility in your spending plan. In that case, the application of dynamic withdrawal rules could materially increase

Maximize your retirement income by considering assets other than your retirement portfolio. Our retirement planning specialists share key strategies for optimum

Read More