Don't Miss Your 2021 Roth IRA Conversion

A strategy of converting traditional IRA (or pre-tax 401k) balances to a Roth IRA is valuable for many.

Current Lower Tax Rates Set to Expire at the End of 2025

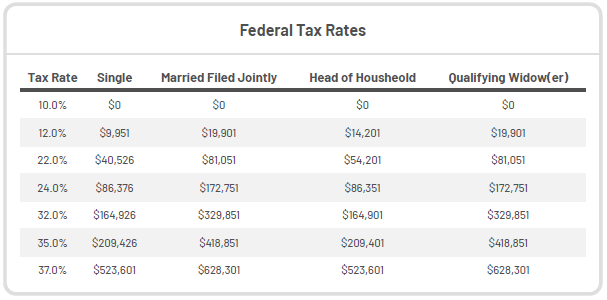

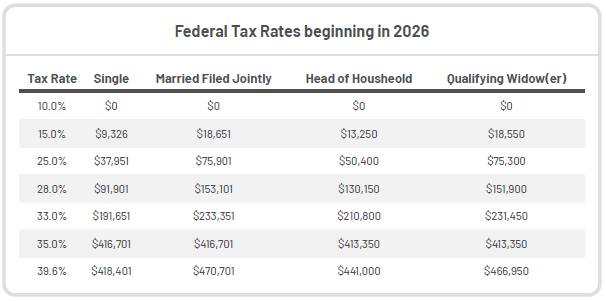

One such factor aiding the math for many is that today's lower marginal income tax rates under the Tax Cut and Jobs Act are set to expire in 2026. At expiration, marginal tax rates are set to revert to the previous higher levels. The difference in personal marginal income tax rates and income thresholds is substantial and can be seen from the charts below:

Many individuals stand to benefit from a strategy of converting IRA assets in 2021, 2022, 2023, 2024, and 2025, realizing income up to some specified marginal bracket and paying taxes each year. By converting some amount of IRA assets and realizing some amount of income each year, the individual can pay income taxes based on the current lower income tax rates and avoid realizing the income after 2025 at higher income tax rates.

Other Benefits of Roth IRA Conversion

Aside from the obvious benefit of paying income taxes now, while personal marginal income tax rates may be lower, there are several less obvious but material benefits to a Roth IRA conversion strategy as well.

Tax Planning for Efficient Retirement Distributions

For beginners, having assets invested in a Roth IRA in addition to an IRA allows you to coordinate withdrawals later to keep yourself just under your highest marginal income tax bracket. For example (ignoring exemptions and other income), assume in 2026 you needed $100,000 from your IRA to help fund your living expenses. Your marginal income tax rate would be 25% if married filed jointly. You would pay 10% on your first $18,650, then 15% on the next $57,250, and finally 25% on your last $24,100. Altogether, your tax bill would be $16,478. But say you funded that last $24,100 from your Roth IRA instead of your traditional IRA, you would reduce your tax bill by 37% and save $6,025. Having sufficient assets in a Roth IRA allows you to create an optimal tax-efficient strategy of ongoing withdrawal coordination to minimize the amount of taxes you pay over your lifetime.

Manage Amount of RMD's

Another less obvious benefit of a properly constructed Roth IRA conversion strategy is that you can lower the amount of your RMD. You can do this by converting your IRA assets to a Roth IRA, reducing the amount of assets left in your traditional IRA accounts that are subject to RMD rules. By lowering the amount of assets in your traditional IRA, you can lower your RMD to a level such that you do not have to recognize income and pay taxes on money that may not be needed.

Passing Money on to Beneficiaries

A Roth IRA conversion strategy can also be used to pass more wealth on to beneficiaries in a tax-efficient way. If you were to leave your traditional IRA assets to your beneficiaries, they would have to withdraw the assets within ten years of your date of death and pay income taxes on the amounts withdrawn in the years taken. There might be two problems with this. First, your beneficiaries might be in a higher marginal income tax bracket than you are, given they are still in their working years. Second, your beneficiaries will have to pay taxes on the assets' ten years of capital growth. If your beneficiaries are in higher marginal income tax brackets than you, paying taxes at your lower rate to convert the assets to a Roth IRA allows the assets to pass and not be taxed at your beneficiaries' higher tax rate later. Additionally, the assets can grow tax-free for ten years before your beneficiaries must withdraw the assets. The result could be additional material wealth being passed to your beneficiaries

Asset Location

Lastly, a Roth IRA account gives a more robust way to execute a strategy known as Asset Location. The idea behind Asset Location is that it is advantageous to hold certain types of assets in certain types of accounts. You can view all of your assets and accounts as one aggregate portfolio. You do not have to create a balanced portfolio in every account. When viewed in this aggregate way, you can take advantage of the fact that capital growth assets, like stocks, are best held in Roth accounts. Why? Because stocks will grow fastest, and that growth will never again be taxed if held in a Roth IRA. Holding bonds in a Roth IRA account would be a waste of that account type's advantage. Income-producing assets, like bonds and REITs, are best held in retirement accounts, so their income distribution can grow tax-deferred rather than become immediately taxable as they would if held in a taxable account.

Roth IRA Conversions Must Be Done Before Calendar Year End

Contributions to an IRA or a Roth IRA are required by the end of the tax year, which is April 15th the following year. For instance, the tax year for 2021 ends on April 15th, 2022. Unfortunately, Roth IRA conversions must be made before the end of the calendar year. For instance, the calendar year for 2021 ends December 31st, 2021.

Not only do Roth IRA conversion requests have to be completed before the end of the calendar year, but you also have to allow time to complete the necessary custodian paperwork and allow the custodian time to process the paperwork. Because custodians tend to get flooded with paperwork prior to year-end, we strive to have all client Roth Conversion requests in by November 30th to assure timely processing.

There is still time if you need help figuring out your optimal Roth IRA conversion strategy. We still have the capacity to take on a couple more clients this year. Please know our planning process takes approximately four weeks. To be sure we have an optimal Roth IRA strategy in place to execute by November 30th means getting started this month, so please do not delay if this is something you are ready to begin. You can select a convenient time and date for an Introductory Call by clicking on this link: https://calendly.com/thriveretire/introductory-call.

ABOUT THRIVE RETIREMENT SPECIALISTS

Thrive Retirement Specialists is a retirement planning specialist dedicated to delivering a more thoughtful and strategic approach to retirement planning for those nearing or in retirement. We are a fee-only Registered Investment Advisor (RIA) offering a single, flat-fee service entitled ThriveRetireTM that goes far beyond what has traditionally been known as retirement planning. ThriveRetire™ is an engaging ongoing 8-step retirement planning process and investment management service that seeks to identify all risks, assets, tools, and tactics to develop an optimal retirement plan designed to support your ideal retirement lifestyle and goals to the fullest extent possible. With every interaction, we seek to inform and serve, so our clients can safely trust their ThriveRetire™ plan and process, leaving each client with the confidence and peace of mind to live a vibrant and full life through retirement.