Why You Shouldn't Miss Your 2023 Roth Conversion

(READ TIME: ~5 MIN)

TAKEAWAYS:

- Federal marginal tax rates are set to increase in 2026, providing taxpayers with a small window of opportunity to maximize Roth conversion tax savings potential.

- Several less apparent benefits of Roth conversions can add value to your retirement plan.

- Roth conversions for the 2023 tax year must be completed by December 31st, but processing time must be considered to ensure they’re completed by the deadline.

A Roth conversion is the process of transferring all or a part of your existing pre-tax retirement account balance (e.g., traditional IRA, 401(k), etc.) to an after-tax Roth retirement account, like a Roth IRA, Roth 401(k), etc. While the IRS has imposed income limitations that prevent high earners from contributing directly to Roth IRAs, there are no limits on the amount of assets that can be converted to a Roth account. But keep in mind that any assets converted to a Roth account are taxed as “ordinary income” (just like employment earnings) in the year of the conversion.

Let’s take a look at why Roth conversions can be a potent retirement planning tool.

Tax Cuts Set to Expire in 2025

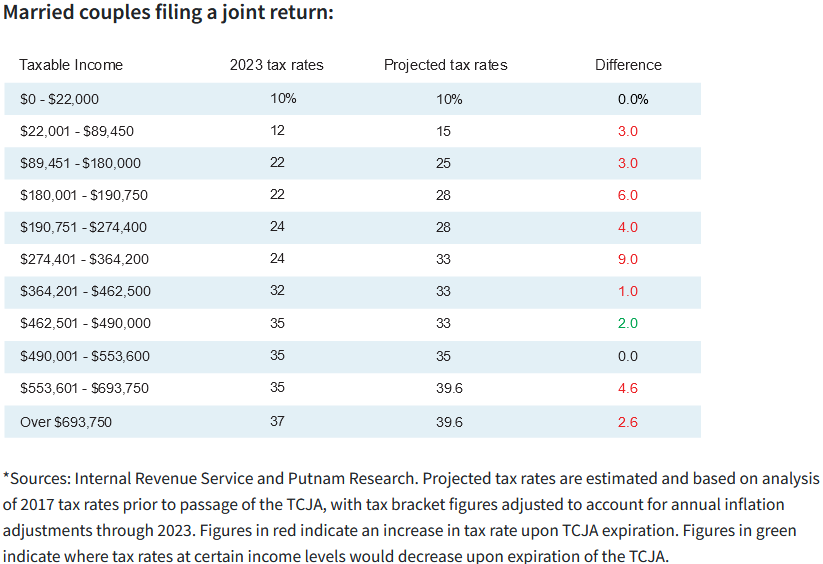

If you prefer to pay less taxes, you don’t want to overlook the tax provisions of the 2017 Tax Cuts and Jobs Act that expire at the end of 2025. Notably, individual income tax rates will revert to their higher, pre-tax cut levels unless Congress acts. Here’s a comparison of the current and 2026 projected tax rates for married couples.

As we can see, many taxpayers can expect to be in a higher marginal tax bracket in 2026 by as much as 9%! For context, a married couple with $364,000 of taxable income in 2023 (the top of the 24% tax bracket) would pay ~$74,000 in federal income taxes. However, if they have the same taxable income in 2026, their taxes will jump to ~$91,000 based on the projected tax brackets above. That’s a $17,000 (or 23%) increase!

This matters because many people can benefit from a Roth conversion strategy that allows them to pay lower taxes today instead of higher taxes tomorrow. A multi-year strategy, such as converting enough IRA assets in 2023, 2024, and 2025 to “fill up” the 24% tax bracket, is one way to “lock in” today’s lower tax rates. If you believe that your tax rates will be higher in the future than they are now, Roth conversions over the next several years could cut your lifetime tax bill by thousands of dollars.

Don't Forget The (Not So Obvious) Benefits of Roth Conversions

Aside from the obvious benefit of paying income taxes now at a lower rate than later at a higher rate, a Roth conversion strategy has several less obvious benefits.

1. Tax-Efficient Retirement Distributions

Having assets invested in a Roth IRA in addition to an IRA allows you to coordinate withdrawals later to keep yourself just under your highest marginal income tax bracket. For example (ignoring exemptions and other income), assume in 2026 you needed $150,000 from your IRA to help fund your living expenses. Based on the projected tax brackets, your marginal income tax rate would be 25% if married filing jointly. You would pay 10% on your first $22,000, 15% on the next $67,449, and finally 25% on your last $60,551. Altogether, your tax bill would be $27,455. But if you funded that last $60,551 from your Roth IRA instead of your traditional IRA, you would reduce your tax bill by 55%, saving $15,137! Having sufficient assets in a Roth IRA allows you to create an optimal tax-efficient strategy of ongoing withdrawal coordination to minimize the taxes you pay over your lifetime.

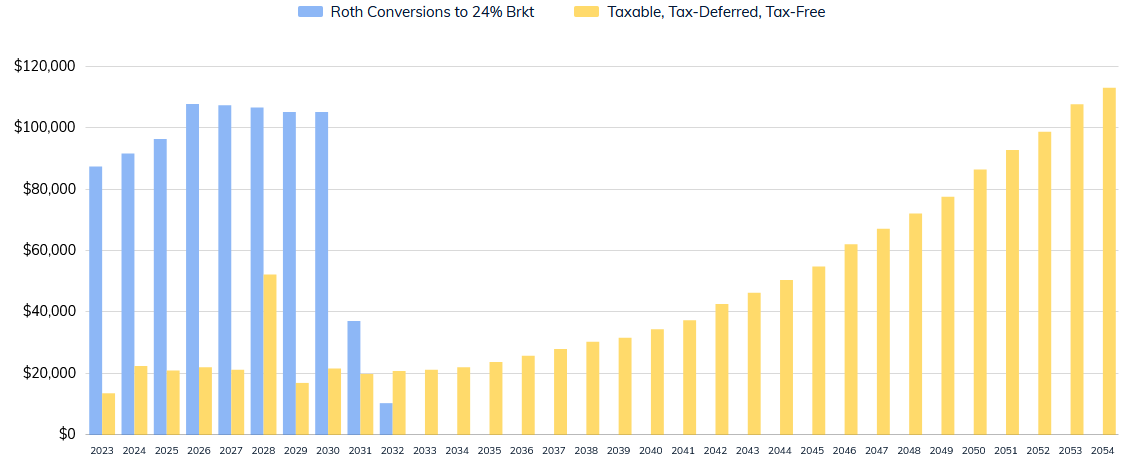

As an example, we have a client that is Roth converting up to their 24% marginal income tax rate each year through 2030 so that beginning in 2031, they have enough money in their Roth IRAs to fund their $150,000 net retirement spending goal while staying in (or below) the 15% tax bracket. Following is a comparison of the couple’s estimated yearly tax liability under their Roth conversion strategy (in blue) and a no-Roth strategy (in yellow). The couple could save almost $600,000 in taxes over 31 years.

2. Reduce Your Required Minimum Distributions

Another less obvious benefit of a properly constructed Roth conversion strategy is that you can lower the amount of your future RMDs. By converting your IRA assets to a Roth IRA, you reduce the amount left in your traditional IRA accounts and transfer the assets’ future growth. By lowering the amount of assets in your traditional IRA, you can lower your RMD so that you do not have to recognize income and pay taxes on money that may not be needed. Reducing RMDs is also an essential strategy for lowering your sequence of returns risk.

Carrying forward our previous example, the following compares the couple’s forecasted RMDs under their Roth conversion strategy (top) and a no-Roth strategy (bottom).

Projected RMDs with Roth conversions (pink bars represent RMD income).

Projected RMDs without Roth conversions (pink bars represent RMD income).

3. Tax-Efficiently Passing Money to Beneficiaries

A Roth IRA conversion strategy can also tax-efficiently pass more wealth on to beneficiaries. If you were to leave your traditional IRA assets to your beneficiaries, the IRS would require them to take required minimum distributions (RMDs) annually and ensure the entire account was depleted within ten years from the date of your death, paying income taxes on all the amounts withdrawn. There might be two problems with this. First, your beneficiaries might be in a higher marginal income tax bracket than you are, given they are still in their working years. Second, your beneficiaries must pay taxes on the assets' ten years of capital growth. If your beneficiaries are in higher marginal income tax brackets than you, paying taxes at your lower rate by converting the assets to a Roth IRA allows the assets to pass and not be taxed at your beneficiaries' higher tax rate later. Additionally, the assets not withdrawn for RMDs can grow tax-free for ten years. The result could be more wealth passing to your beneficiaries.

4. Asset Location

Lastly, a Roth account provides a more robust way to execute an investment management strategy known as “asset location.” The idea behind asset location is that holding certain types of assets in certain types of accounts is advantageous. You can view all your assets and accounts as one aggregate portfolio rather than creating a balanced portfolio in every account. When viewed in this aggregate way, you can take advantage of the fact that capital growth assets, like stocks, are best held in Roth accounts. Why? Because stocks have the most expected growth, and that growth will never again be taxed if held in a Roth IRA. Having bonds in a Roth IRA account would waste that account type's tax advantage. Income-producing assets, like bonds and REITs, are best held in retirement accounts, so their income distribution can grow tax-deferred rather than become immediately taxable as they would if held in a taxable account.

December 31st Deadline

There are many factors to consider in developing a Roth conversion strategy, and the strategy must be constructed based on a couple’s (or individual’s) unique circumstances, resources, and goals.

Although contributions to an IRA or a Roth IRA can be made by the tax filing deadline of April 15, 2024, Roth conversions must be made by December 31st. Not only do Roth IRA conversion requests have to be completed by year-end, but processing times also need to be considered. Because retirement account custodians (like Schwab) tend to get flooded with paperwork before year-end, we strive to have all client Roth conversion requests in by November 30th to ensure timely processing.

There is still time if you need help figuring out your optimal Roth conversion strategy. We can still take on a handful of clients this year, but ensuring we have a strategy by November 30th means getting started soon.

If you are ready for a Roth conversion strategy customized to your unique circumstances, we are here to help. You can click here to schedule an informal, introductory Zoom call to get started.